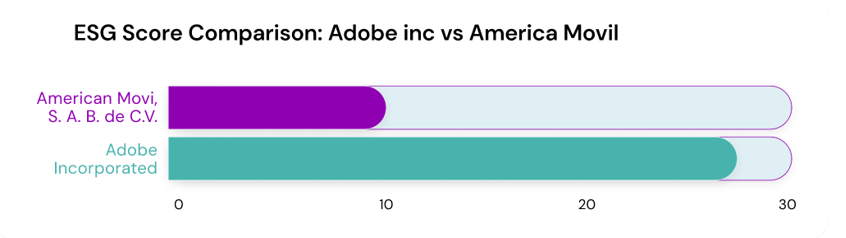

Large North American corporations, faced with growing international investor pressures and consumer expectations around sustainability, have long been integrating robust ESG strategies into improving their sustainability performance. An illustrative example is Adobe Inc, a large US corporation belonging to many global indices such as NASDAQ Composite, S&P 500 IT, Russell 1000 etc, which due to the risks poorly managed ESG factors can pose for their stock demand and prices, appear to stand out with a high ConsciESG scores, reflecting consistent progress to meeting their various ESG targets . Associating Adobe with a positive ESG performance, many asset managers are likely to find Adobe stock more lucrative, in light of growing client preferences for impact and the growing regulatory pressures, especially in the EU. Conversely, other public firms in developing markets, regardless of a clear more recent trend to catch up on the integration of ESG factors into their business operations, are still lacking a clear and robust vision in doing so. América Móvil, its lower ESG progress scores, reflective of a lower consistent progress to the same ESG targets, may also reflect the lack of regulatory pressures together with resource constraints, making it put secondary importance to ESG factors at the expense of its stock demand and valuation. However, based on our scores, a low Ante score of 11 demonstrates the start of America Movil’s real actions at improving their ESG performance to reach targets aligned with the global sustainability goals, turning America Movil’s stock into one that presents a high growth potential for asset managers willing to engage with transitional markets.

Figure 1: Bar Chart Comparison of ESG Score, Adobe Inc vs. America Movil

Asset managers looking for alpha opportunities recognize that ESG performance gaps between companies in developed and developing markets are narrowing over time. Developing market firms are improving as they catch up on and learn from global best practices.

Through platforms like ConsciESG, asset managers can access comprehensive ESG progress data, as seen in this comparison between Adobe and América Móvil. Our proprietary methodology, which relies on publicly available sustainability reports (collected from 2020-2021), provides clear, actionable insights. This allows managers to not only track current ESG standings but also predict which companies are likely to accelerate in sustainable practices.

With ConsciESG's platform, asset managers are empowered to:

- Benchmark ESG Performance: Our platform enables comparative analysis, like the one presented, giving investors clear visibility into ESG leaders and laggards.

- Data-Driven Decisions: Leveraging our ESG progress scoring system helps asset managers make informed, data-backed decisions that align with sustainability mandates and deliver higher returns

Asset managers who focus solely on developed market ESG leaders may miss the significant upside potential in developing markets. As the comparison between Adobe and América Móvil shows, there are gaps but also opportunities for rapid growth. By leveraging the data and insights from ConsciESG, asset managers can navigate these challenges and make strategic decisions that balance risk and reward across global markets.