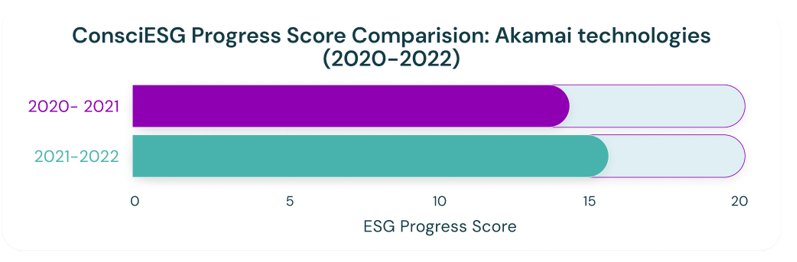

The following case reflects how a more data-driven communication of a company’s ESG actions, are picked up by the ConsciESG progress scores. Our scores, reflective of a company’s real progress to ESG targets, in turn, predict how investor demand and alternatively its stock price responds to such enhanced ESG improvement actions. Akamai Technologies, from 2020 to 2021 had many ESG reporting inconsistencies, which alternatively led to reduced ESG progress, hindering its stock appeal to asset managers seeking reliable ESG performance. For comparison Akamai’s significant improvements in the following 2021-2022 period, were reflected in its enhanced ESG progress scores, as shown in the figure below.

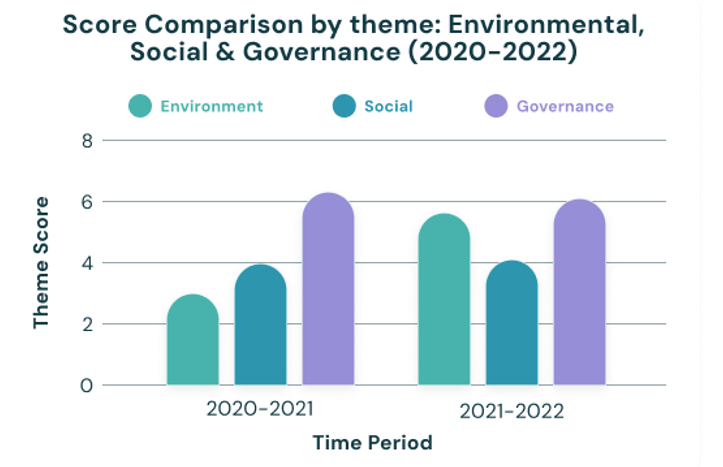

Referring to the pillar breakdown below, Akamai’s Environmental, Social, and Governance (ESG) weight-adjusted scores increased across all three pillars, as it started to more consistently and actively target, tackle and report its ESG performance versus its targets. In the 2020-2021 period, during a poor reporting year, the Environmental theme lagged behind at 2.5, compared to a stronger Governance score of 6.5. By the 2021-2022 period, however, Akamai’s Environmental score improved to 5.5, while Governance remained steady at 6.0. The Social pillar also saw an increase from 4.5 to 5.0, reflecting progress across all major ESG themes.

Figure 1: Bar Chart comparison of score by ESG theme (2020-2022).

This thematic breakdown showcases how Akamai took deliberate steps to address environmental issues, while sustaining progress in governance and social themes. These efforts resulted in an overall ESG progress score increase from 12.0 in 2020-2021 to 15.8 in 2021-2022.

Figure 2: Bar Chart comparison of ESG Score (2020-2022).

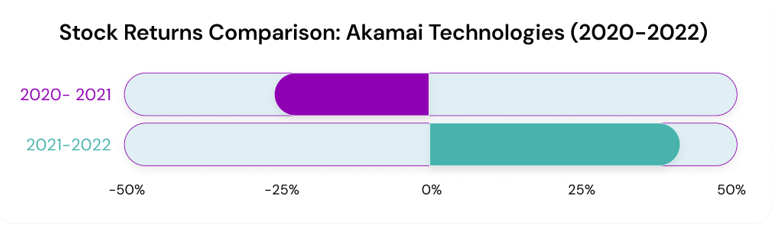

The improvement in ESG disclosure also had a measurable effect on the company’s stock performance, which asset managers using ConsciESG scores would be capable of picking up During the 2020-2021 period, Akamai suffered a negative stock return of -25%, largely due to market skepticism around the company's sustainability commitments. However, with better reporting and demonstrated progress, Akamai's stock returns rebounded in 2021-2022, delivering a positive return of 42%. The correlation between improved ESG data and financial performance became evident, signaling to asset managers that strong ESG practices not only benefit society but can also enhance shareholder value.

Figure 3: Bar Chart comparison of stock returns (2020-2022).

For asset managers, Akamai’s journey underscores the importance of high-quality ESG data. Asset managers often need reliable ESG insights to assess risk and uncover investment opportunities. In Akamai’s case, as their ESG transparency and performance improved, so did their stock return. The ConsciESG platform helps asset managers gain deep insights into a company’s ESG progress, providing a detailed and objective analysis of year-over-year improvements and preceding any valuation changes that follow due to the market’s response to a company’s measurable ESG actions

Our methodology focuses on both ESG progress and financial materiality, ensuring that asset managers can identify firms on a sustainable trajectory with strong stock price growth potential. Akamai’s experience illustrates how ESG improvements can directly influence market performance, making it an appealing investment for those managing portfolios with both impact and returns in mind.

ConsciESG is crucial in uncovering such hidden value, offering asset managers a comprehensive tool for analyzing companies' ESG progress. Akamai's progress demonstrates how improvements in sustainability practices can lead to better financial returns, showing the power of ESG when accurately measured and disclosed. As ESG regulations tighten, and as ESG investment continues to grow, asset managers’ need for a scoring system reflective of real ESG progress will continue to rise.