As ESG becomes central to investment strategies, companies are under intense pressure to improve their Environmental, Social, and Governance (ESG) reporting. However, many businesses face significant hurdles in fully disclosing this data, particularly when it comes to environmental and social factors. Governance often receives the most attention, driven by regulatory standards, but tracking and reporting on environmental impact and social responsibility is far more complex. These challenges persist despite the global push for transparency, leaving gaps in ESG reports that could affect both regulatory compliance and investor confidence.

The difficulty lies in the complexity of collecting reliable data across all ESG dimensions. For example, measuring governance is relatively straightforward, focusing on established standards like board diversity and executive compensation. Yet when it comes to environmental impact, such as emissions or energy consumption, and social metrics like workforce conditions or community involvement, companies often struggle with tracking and reporting. Inconsistent data collection, lack of standardized frameworks, and the sheer scale of environmental and social factors contribute to incomplete reporting.

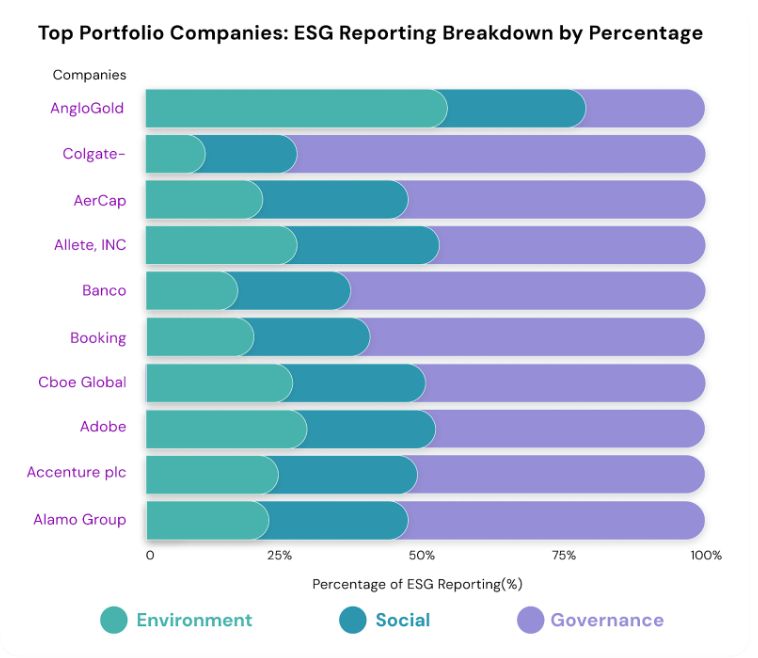

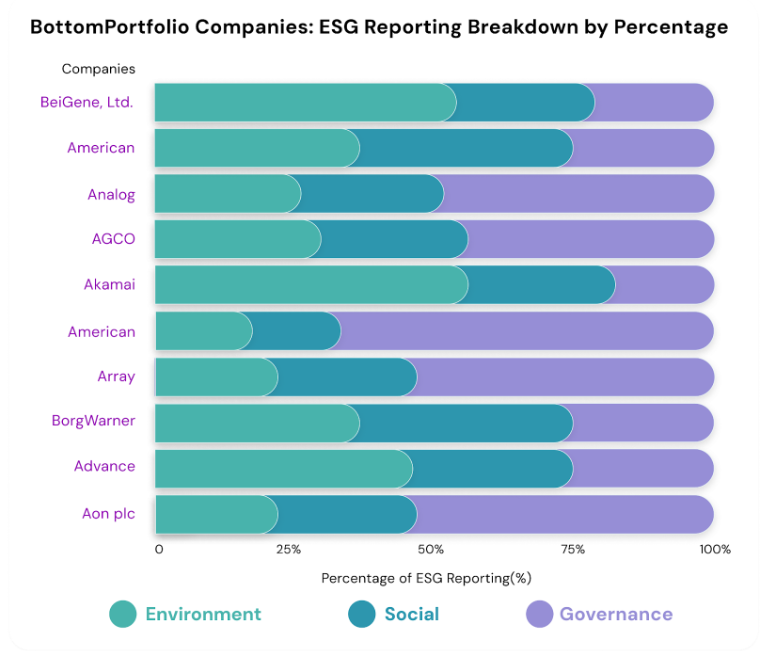

The data was derived from a sample of 300 companies, analyzed using ConsciESG's ESG progress scoring from 2020 to 2021. Companies were ranked into top and bottom performers based on their progress ESG scores. The graphs below show the reporting percentages of these companies across the three ESG pillars—governance, social, and environmental—highlighting the challenges faced by both top and bottom portfolios.

From the top portfolio graph, companies like American Homes 4 Rent and AGCO Corporation have comprehensive governance reporting but are visibly weaker when it comes to environmental and social disclosures. Similarly, in the bottom portfolio, AerCap Holdings and Banco Santander excel in governance but report less than 50% of their expected environmental data.

These discrepancies demonstrate how widespread the issue of incomplete ESG reporting is, particularly in areas beyond governance. Data gaps can influence the ESG score of a company and as such the demand for its stock in the market, consequently affecting its price. Companies that are considered top performers are still struggling with consistent environmental and social disclosures, and bottom performers show even greater gaps. As global regulations tighten, this underreporting could lead to increased risks, from regulatory penalties to diminished investor confidence.

This is where ConsciESG proves invaluable. By providing unparalleled transparency, ConsciESG helps asset managers and investors identify exactly where companies are under-reporting or failing to meet ESG expectations. ConsciESG's platform highlights areas where companies are not reporting as comprehensively on their environmental and social metrics, despite their governance strengths. This level of detail gives asset managers a clearer picture of ESG risks and opportunities, enabling more informed investment decisions and compliance with evolving regulations. ConsciESG’s AI-powered tools also help quantify the financial implications of these reporting gaps, offering investors data-backed strategies for enhancing both financial returns and sustainability. Importantly, ConsciESG’s platform, provides the fund manager with an embedded reporting tool, which can be used by the asset manager to demand portfolio companies to fill in data gaps in themes that can be material to ESG portfolio management or during proxy voting.