Understanding the interplay between a company's Environmental, Social, and Governance (ESG) performance and its financial returns is essential for asset managers. ConsciESG, a leading platform in ESG portfolio-level analytics, provides valuable insights through its comprehensive methodology for evaluating the progress of companies to their ESG targets. Recent data from ConsciESG, based on public sustainability reports (2020-2021) and subsequent stock returns (2021-2024), sheds light on whether ESG scores on average significantly vary by company size.

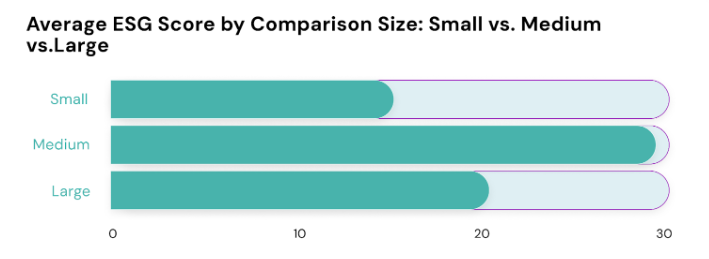

Figure 1: Bar Chart Average ESG Scores by Corporation Size

The first graph illustrates the average ESG scores across small, medium, and large corporations, as determined by ConsciESG's scoring system. Notably, medium-sized companies exhibit the highest ESG scores, followed by large corporations, with small companies trailing behind. This suggests that medium-sized firms may be more agile in implementing sustainable practices, possibly due to fewer bureaucratic hurdles compared to their larger counterparts, while still having more resources than smaller firms.

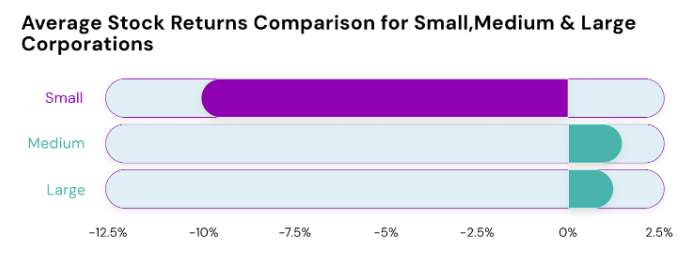

Figure 2: Bar Chart Average Stock Returns by Corporation Size

Conversely, the second graph presents a striking contrast in average stock returns for the same period. Small corporations, despite their lower ESG scores, have experienced significantly negative average stock returns, while medium and large corporations have managed to maintain slightly positive returns. This divergence underscores the potential risk associated with investing in smaller firms, particularly those with lower ESG scores.

For asset managers, these findings emphasize the importance of considering corporation size as a key variable in ESG-focused investment strategies. With ConsciESG's platform offering precise ESG progress scores, medium and large companies appear to offer a more balanced approach to sustainability and financial performance, making them attractive candidates for ESG-conscious portfolios.

ConsciESG offers a powerful advantage for asset managers by providing precise and comprehensive ESG progress scores, which are critical for making informed investment decisions. By utilizing ConsciESG's advanced methodology, managers can accurately assess how different corporation sizes perform in terms of sustainability, as demonstrated in this case. The ability to correlate ESG scores with stock returns enables managers to identify investment opportunities that align with both financial performance and sustainability goals, ensuring a more resilient and forward-looking portfolio.