As ESG factors become central to investment strategies, asset managers face the challenge of balancing sustainability with financial performance. With increasing regulatory demands and market focus on ESG, tracking the progress of companies in their sustainability efforts can reveal valuable insights for portfolio ESG risk management investment decision-making. This case examines the ESG progress and stock returns of two companies: Algonquin Power & Utilities Corp., a renewable energy firm, and Antero Resources Corporation, a natural gas producer, using data collected from their public sustainability reports between 2020 and 2021.

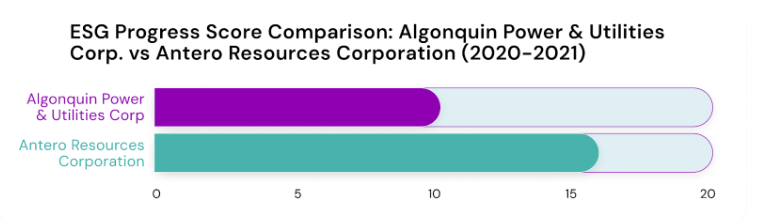

Data from the 2020 and 2021 sustainability reports of Algonquin Power & Utilities Corp. and Antero Resources Corporation was analyzed using ConsciESG's proprietary methodology to calculate their respective ESG progress scores. Algonquin Power & Utilities Corp., with its commitment to renewable energy, earned a progress score of 10.31, reflecting its continued efforts in driving sustainable energy solutions.

In contrast, Antero Resources Corporation, a natural gas producer, recorded a higher ESG progress score of 16.88. Despite being from a traditionally brown sector, Antero's score indicates significant strides in reducing its environmental impact and advancing its sustainability practices. This comparison highlights that companies within high-carbon industries can achieve notable ESG progress and should not be overlooked by asset managers seeking sustainable investment opportunities.

Figure 1: Bar Chart: Comparison of ESG Progress Scores between 2020-2021

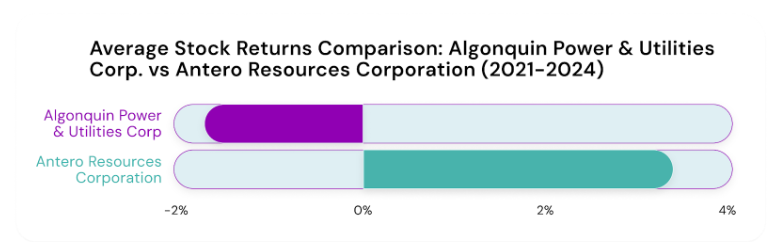

While ESG progress provides a valuable measure of sustainability, it is essential for asset managers to also consider financial returns when evaluating companies. Algonquin Power & Utilities Corp. posted a stock return of -1.45% from 2021 to 2024, indicating a slight decline during this period despite its ESG advancements.

On the other hand, Antero Resources Corporation saw a 3.26% stock return, demonstrating that brown companies making substantial ESG progress can still generate positive financial results. This suggests that investors should not solely focus on the sector a company operates in but rather on the momentum of its ESG improvements and its potential to offer both impact and financial gains.

Figure 2: Bar Chart: Stock Returns between 2021-2024

ConsciESG's platform offers a powerful solution for asset managers grappling with the complexities of ESG investing. By collecting data from public sustainability reports and applying its unique methodology, ConsciESG provides a forward-looking view of a company's progress toward specific ESG targets. This allows asset managers to identify companies that are improving their ESG performance over time, even if they belong to traditionally brown sectors.

With ConsciESG's in-depth progress tracking, asset managers can make more informed decisions, balancing sustainability with financial outcomes. In a world where ESG is increasingly material to investment performance, ConsciESG equips asset managers with the tools needed to stay ahead of the curve.

ConsciESG's platform is a critical tool for asset managers who want to integrate ESG into their investment strategies while maximizing financial returns. By gathering data from public sustainability reports and applying its proprietary scoring methodology, ConsciESG tracks and ranks companies' progress across key ESG themes, offering a comprehensive and forward-looking view of their ESG performance.

In an environment where ESG is becoming increasingly tied to investment outcomes, ConsciESG provides the necessary insights and tools to optimize both impact and returns for asset managers.