As LP expectations continue to grow, the demand for transparency and detailed portfolio ESG reporting has reached new heights. Traditional ESG scoring systems often provide a single, aggregated score; they fail to provide a breakdown on the real actions necessary to justify a fund’s alignment with the specific ESG requirements of LPs. ConsciESG offers a transformative solution to this issue by delivering ESG scores and granular insights that can help a fund manager minimize the ESG risk of their portfolios and easily report the ESG alignment of their portfolios to the limited partners, on every theme material to them.

Unlike conventional ESG ratings that lump together various aspects of a company’s sustainability efforts into a single score, ConsciESG’s subcategory approach provides asset managers, investors, and stakeholders with a deeper and more precise view of a company’s ESG performance. The Environmental score hones in on a company’s impact on natural resources, carbon emissions, water and waste management. The Social score, meanwhile, assesses elements of DEI and labor practices in the workforce, including the supply chain, while the Governance score focuses on the company’s leadership DEI performance.

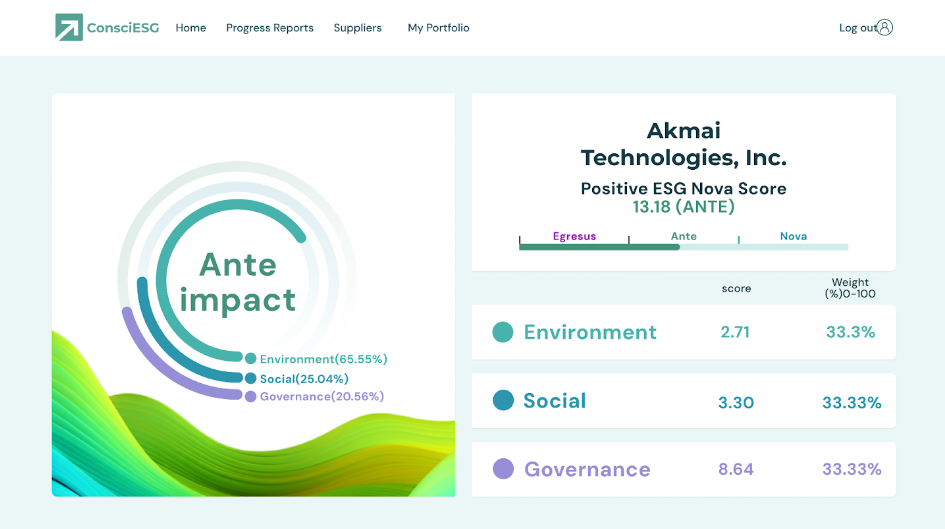

To illustrate, consider Akamai Technologies, which has a total ESG score of 13.18. This score is further broken down into subcategories: 2.71 for Environmental, 3.3 for Social, and 8.64 for Governance. This detailed breakdown provides a more comprehensive view of the company's performance across all ESG dimensions.

This subdivision into specific ESG pillars allows for a targeted analysis that can inform more tailored and granular investment strategies. Asset managers can now prioritize areas that align with their investment thesis or sustainability goals. For instance, a fund focused on reducing environmental impact can pinpoint companies with strong environmental scores, even if their social or governance scores are not equally high. Conversely, investors concerned with social issues, such as diversity and inclusion, can focus on companies excelling in that subcategory.

This detailed breakdown ensures that underperformance in one area does not unfairly penalize companies making significant strides in another. It offers a balanced view that allows for better risk assessment and more strategic engagement with investors.