The growing importance of Environmental, Social, and Governance (ESG) factors has transformed investment strategies, with ConsciESG scores becoming a vital tool for identifying companies making significant progress in sustainability. This case study examines the performance trends of top and bottom ConsciESG performers compared to the S&P 500 index over the period from 2021 to 2024.

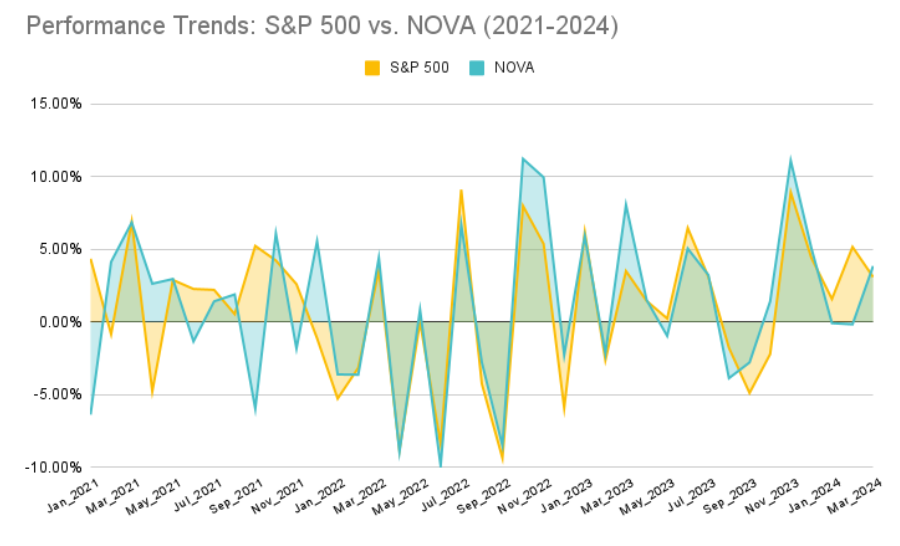

The top performers identified by ConsciESG scores represent companies that excelled in advancing their ESG initiatives based on data collected from 2020 to 2021. Our methodology determined that these companies had the highest scores, reflecting their strong commitment to ESG factors. The top ConsciESG performers returns demonstrated a strong positive trend compared to the S&P 500, as illustrated in Figure 1. Despite market fluctuations, these companies managed to maintain a competitive edge, showcasing their commitment to sustainability. The returns of top ConsciESG performers indicate that prioritizing ESG factors can lead to portfolios that outperform benchmarks financially.

Figure 1: Top Performers sample versus the S&P 500 historical returns.

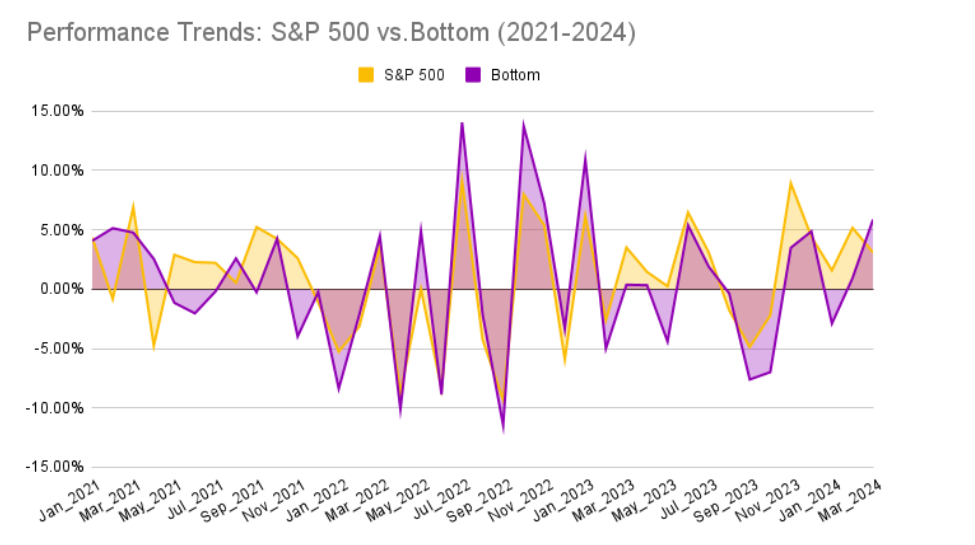

On the other hand, the bottom performers portfolio, as determined by ConsciESG scores, include companies that have lagged in their ESG progress based on data collected from 2020 to 2021. The comparison in Figure 2 between the S&P 500 and bottom ConsciESG performers reveals a more volatile and often underperforming trend for the latter. These companies faced greater challenges in aligning their practices with ESG standards, which is reflected in their stock performance. The returns of bottom ConsciESG performers were generally lower and more inconsistent compared to the S&P 500. This difference highlights the potential risks associated with investing in firms that lag in ESG initiatives.

Figure 2 Bottom Performers (Egressus) sample versus the S&P 500 historical returns.

The analysis of top and bottom ConsciESG performers against the S&P 500 further reveals the risk and reward dynamics associated with ESG-focused investments. The top performers, as depicted in Figure 1, not only managed to outperform the benchmark but also exhibited a lower Beta of 0.7778 compared to the S&P 500, indicating less sensitivity to market fluctuations. Additionally, the top performers generated a positive Jensen's Alpha of 0.34%, suggesting that these companies have provided returns in excess of what was predicted by their level of systematic risk, with an annualized return of 4.04%. This reflects the financial benefits of prioritizing ESG initiatives, underscoring the potential for sustainable investments to deliver superior returns.

Conversely, the bottom performers, as shown in Figure 2, displayed a Beta of 0.9561, closer to the market, which indicates higher volatility in alignment with the S&P 500. The negative Jensen's Alpha of -0.43% for these companies highlights their underperformance relative to the expected market return, with an annualized return of -5.16%. These metrics underscore the financial risks associated with investing in companies that are lagging in ESG progress. This analysis reinforces the importance of ESG integration in mitigating investment risks while potentially enhancing returns.

This case study underscores the strategic value of integrating ConsciESG scores into investment decisions. By analyzing the performance trends of top and bottom ESG performers against the S&P 500, it becomes clear that prioritizing sustainability not only aligns with ethical investment practices but also offers robust financial returns. Investors are encouraged to consider both top and bottom ESG performers to maximize their impact and achieve a balanced, sustainable investment portfolio.