ConsciESG has developed a model that scores companies based on the realized progress that they are making periodically, towards their predetermined targets. Such scores are 100% quantitatively derived, focusing on a set of 17 ESG themes that are selected to universally represent, regardless of size, industry or location, the scope of real actions that companies take to improve their impact on the environment and society. Such scores provide an objective comparison of progress and can be used as a reference point by asset managers and various financial institutions, who seek to pick portfolios of companies that are implementing real actions towards their environmental, social and governance agenda.

The case of Aurubis AG (Aurubis) and Agnico Eagle Mines Ltd. (Agnico) below highlights a reversal in rank that we often observe, as we compare our scores, objectively derived, with the scores derived from standard ESG risk frameworks, such as the Sustainalytics Comprehensive Risk Rating Approach.

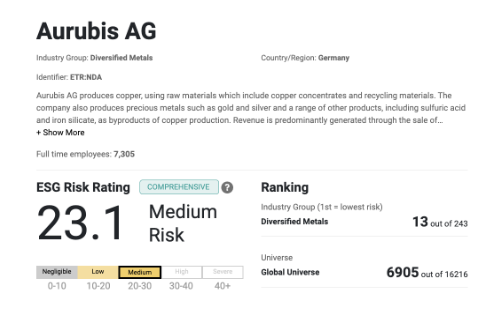

Both Aurubis and Agnico are two prominent companies in the metals industry, each excelling in different areas of ESG (Environmental, Social, and Governance) performance. Aurubis operates in the diversified metals sector, focusing on copper production, while Agnico Eagle Mines is a gold mining company. Based on the Sustainalytics Risk Ratings, Agnico, with a score of 21.1 outperforms Aurubis, with a score of 23.1. This places Agnico 1360 spots higher in an asset manager’s list, when using Sustainalytics scores as a reference point. Refer to Figure 1a and 1b below for a visual comparison between the two companies scores per the Sustainalytics Risk Rating System.

Figure 1a: Aurubis ESG Risk Rating by Sustainalytics

Figure 1b: Agnico ESG Risk Rating by Sustainalytics

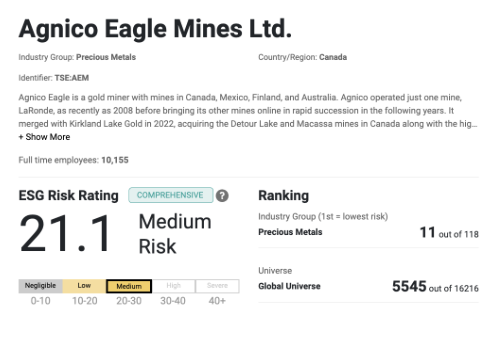

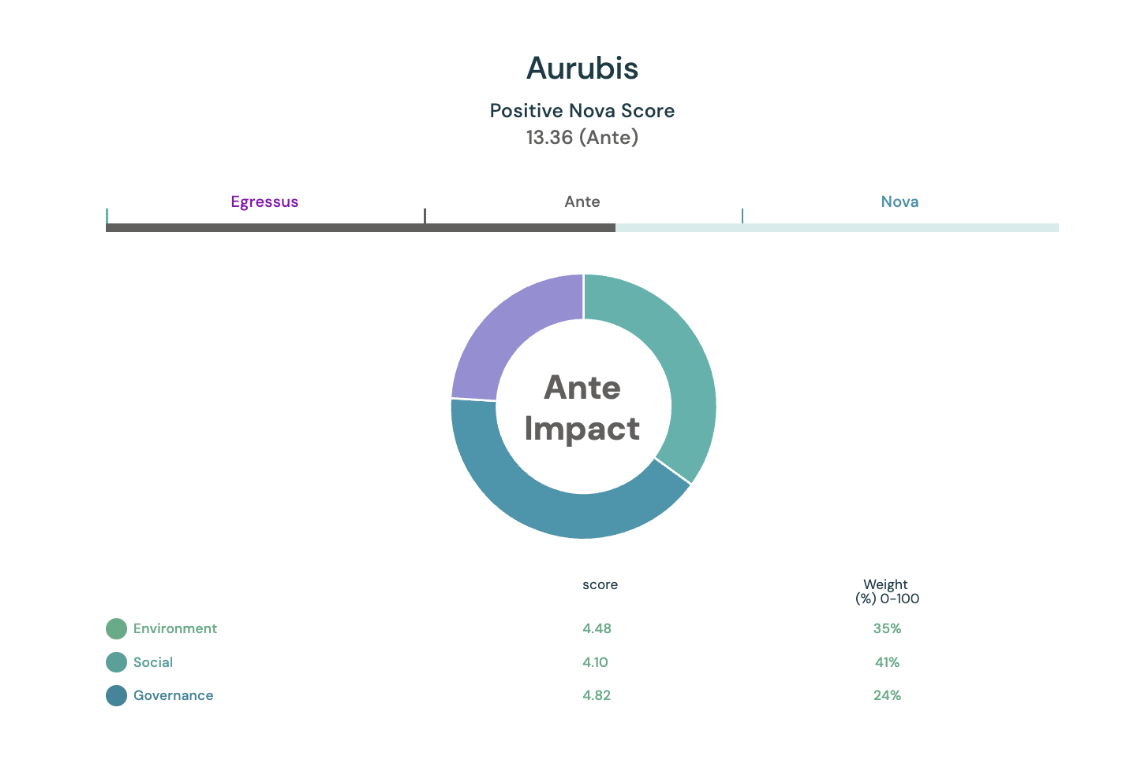

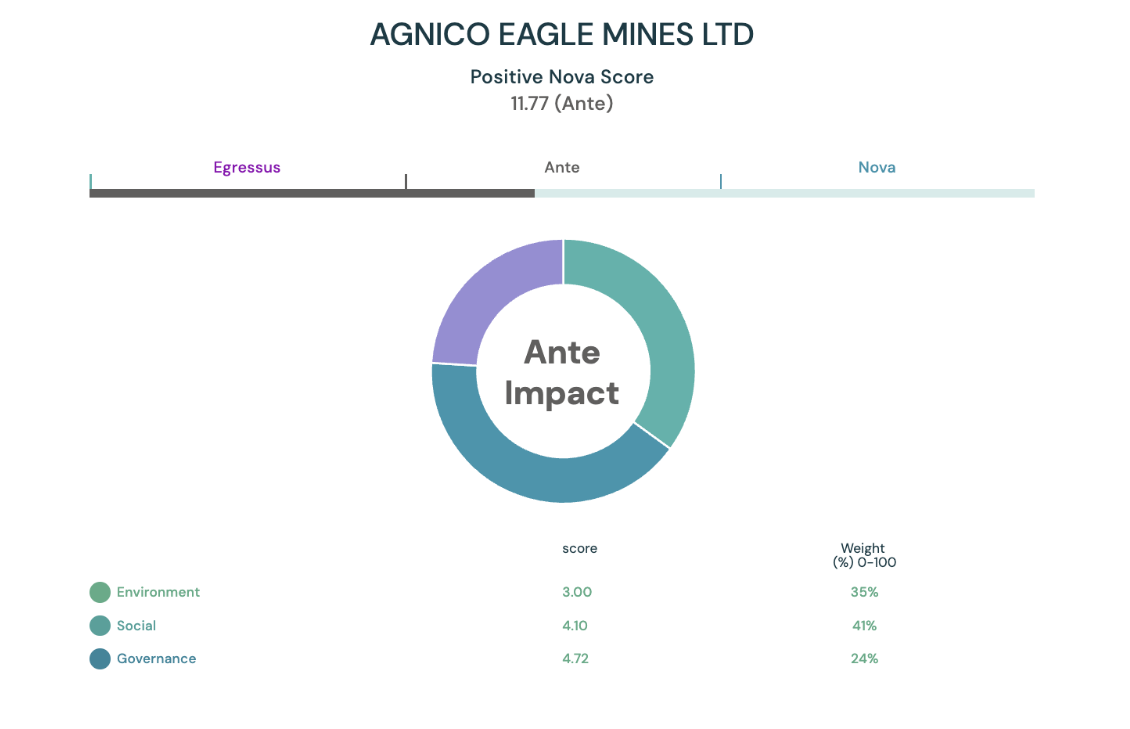

The rank is reversed significantly, when the two companies are instead scored following the ConsciESG progress model. Using performance data for Aurubis and Agnico for 2021 and 2022, extracted from their respective public sustainability reports, we computed Aurubis to have a progress score of 13.36 (highest means more progress), which outperformed Agnico’s score of 11.77. An informed investor, in this case would select Aurubis over Agnico, due to its higher ESG progress performance.

There are key reasons why ConsciESG scores provide completely different actionable insights from other existing providers, but in the case of ESG risk ratings, the key differences arise due to the qualitative bias that risk scores carry, as they often pick-up on “hot” ESG buzzwords used by the companies for marketing purposes, as opposed to the real actions that are being put into converging towards targets. For the difference between Aurubis’ and Agnico’s performance, per the ConsciESG methodology, refer to Figure 2a and 2b respectively.

Figure 2a: Aurubis ESG Progress Score by ConsciESG

Figure 2a: Agnico ESG Progress Score by ConsciESG