In recent years, the evaluation of Environmental, Social, and Governance (ESG) performance has become crucial for companies aiming to attract investors and ensure sustainable growth. ConsciESG, a leading ESG assessment platform, provides detailed insights into companies' progress towards ESG goals. This case study examines one of the underperformers from our previous analysis, revealing how data gaps can significantly affect ESG scores and highlighting the importance of historically balanced data that go to build ESG scores.

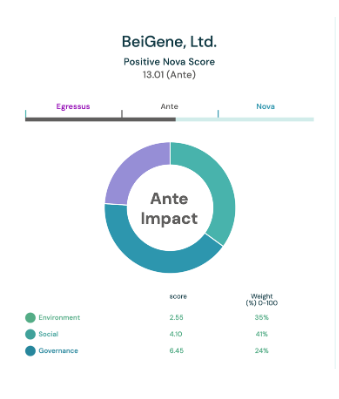

In our initial evaluation covering the period from 2020 to 2021, the selected company showed a low positive progress score. This underperformance raised concerns about BeiGene’s commitment and capability to meet ESG targets on time. The low progress score was primarily attributed to limited data availability, which hindered a comprehensive assessment of the company’s ESG initiatives.

Figure 1: BeiGene, Ltd. Initial ESG Scores (2020-2021)

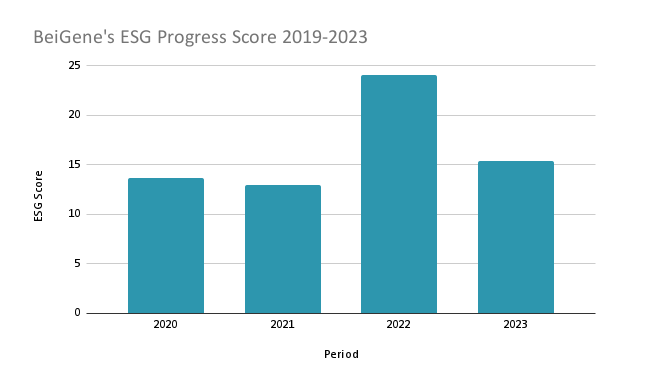

To address concerns, we expanded our analysis to include data spanning from 2019 to 2023. This wider range offered a fuller view of the company's journey regarding environmental, social, and governance (ESG) performance. The findings revealed significant improvements, mainly due to progress in previously underperforming areas. Attached figure visually illustrates the progress made from 2019 to 2023, affirming our observations. However, it's crucial to note that BeiGene's advancement has seen fluctuations, with notable progress in 2021-2022, yet the company still faces challenges in achieving a leading portfolio status.

Figure 2: Bar Chart of BeiGene’s ESG Progress Score

The initial dataset from 2019 showed minimal progress towards ESG goals, aligning with the low scores observed in the 2020-2021 analysis.. The company's efforts were nascent, and the lack of robust data contributed to an unfavorable assessment. By 2021, the company had ramped up its ESG activities, reflected in the significant score increase to 24.07 for 2021-2022. Despite still being affected by earlier data gaps, this positive trend indicated the company's improving commitment to ESG goals. However, the regression in 2022-2023 underscores the importance of continuous and consistent efforts. This case emphasizes that while comprehensive data over time can reveal true progress, it also necessitates ongoing commitment to sustain and enhance ESG performance.

The analysis of BeiGene, Ltd. across different years highlights the dynamic nature of ESG performance. The company demonstrated significant progress from 2020 to 2022, but the regression in 2022-2023 underscores the need for continuous improvement and consistent efforts. This case emphasizes that while comprehensive data over time can reveal true progress, it also necessitates ongoing commitment to sustain and enhance ESG performance.

The comparison between the initial and extended analyses underscores the detrimental impact of data gaps on ESG assessments. Limited data can lead to unfairly low scores, which misrepresent a company's actual efforts and achievements. For investors and stakeholders relying on ESG scores for decision-making, such gaps can result in misinformed judgments, potentially leading to overlooked investment opportunities.