Our platform, ConsciESG, is designed to reveal the actual progress of companies and cut through potential greenwashing. By focusing on tangible advancements in ESG metrics, we provide investors with a clearer picture of which companies are genuinely improving and which are merely maintaining the status quo. This approach empowers investors to make smarter decisions, ensuring their portfolios contribute effectively to global sustainability goals.

In pursuing a net-zero world, investors often gravitate towards green companies, neglecting their brown counterparts. This bias, while well-intentioned, may inadvertently hinder the overall goal of reducing carbon emissions. Our analysis of two mining industry companies—Agnico Eagle Mines Limited (green) and AngloGold Ashanti Limited (brown)—reveals unexpected insights into ESG progress and the potential benefits of a more balanced investment approach.

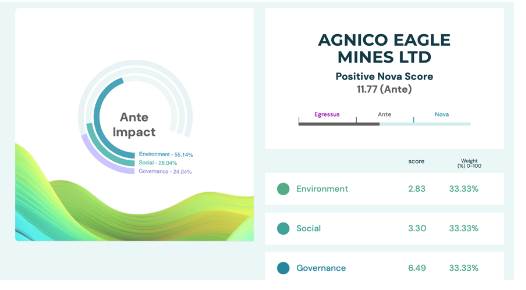

Using the ConsciESG methodology, which focuses on progress scores in ESG metrics, we have gathered and analyzed data from both companies' 2022 and 2023 sustainability reports. Surprisingly, Agnico Eagle Mines Limited, despite being a brown company, has a progress score of 11.77. In addition, AngloGold Ashanti Limited, also categorized as a brown company, has a higher progress score of 13.29. This indicates that both companies, despite their brown status, have made significant progress in improving their ESG impact over the analyzed period.

Figure 1a: Screenshot from ConsciESG Platform of Agnico Eagle Profile

Figure 1b: Screenshot from ConsciESG Platform of AngloGold Ashanti Limited Profile

AngloGold Ashanti Limited places a larger emphasis on environmental impact by reporting on 61.78% of environmental themes, compared to Agnico Eagle Mines Limited, which reports on 55.14%. This suggests that AngloGold Ashanti is more focused on measuring and addressing environmental issues.

Agnico Eagle Mines Limited, on the other hand, shows a slightly higher focus on social aspects, reporting on 28.04% of social themes, while AngloGold Ashanti reports on 24.83%. This indicates that Agnico Eagle Mines is more committed to tracking and improving social factors.

In terms of governance, both companies have similar levels of focus, with AngloGold Ashanti reporting on 23.40% of governance themes and Agnico Eagle Mines reporting on 24.04%. This minor difference suggests comparable attention to governance issues in their reporting and measurement.

The path to a net-zero world requires a nuanced investment approach. While green companies play a crucial role, the transformation of brown companies is equally important. Our case study of Agnico Eagle Mines Limited and AngloGold Ashanti Limited underscores the potential for progress in unexpected places. By leveraging platforms like ConsciESG, investors can support a balanced portfolio that fosters actual environmental advancements, helping to create a sustainable future for all.