Postulate 2: Our impact scores are the only ones that can be internalized by firms and translated into real impact progress

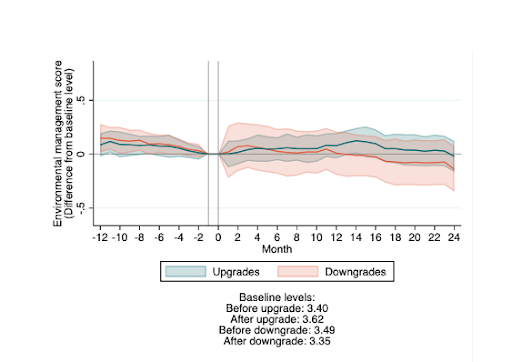

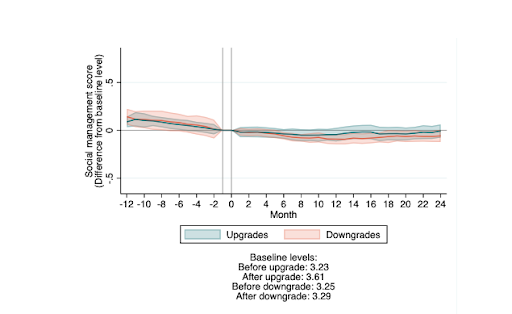

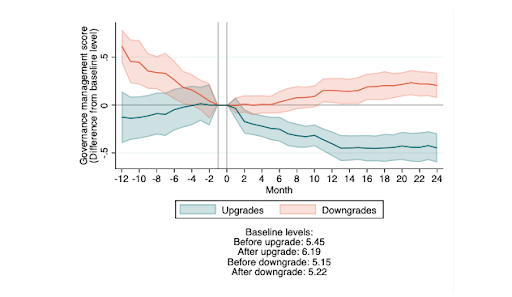

A 2022 academic study, The Economic Impact of ESG Ratings, shows that US companies react when their ESG risk scores are downgraded on the governance, but not on the social & environmental dimensions. In our view this is because existing ESG risk scores that currently inform ESG investments are derived from a company’s management of ESG controversies, so it should come to no surprise that firms will only change their governance to address a scoring downgrade, without having to improve through real actions on the environmental and social aspects. Figures 7-9 below demonstrate a low response of firms to specifically MSCI ESG ratings upgrades and downgrades on the Environmental and Social dimensions and a high reaction to downgrades on the governance dimension. The study takes MSCI ESG ratings into account primarily because it is the most relevant rating for the holdings of mutual funds in the US. Quoting MSCI, its ESG risk ratings “aim to measure a company’s management of financially relevant ESG risks and opportunities”. We expect a study done using other ESG risk providers’ ratings would result in similar conclusions, given that most major ESG risk scoring methodologies assess controversy management over real actions.

Figure 7: source: The Economic Impact of ESG Ratings

Figure 8: source: The Economic Impact of ESG Ratings

Figure 9: source: The Economic Impact of ESG Ratings

Postulate 3: Our scores provide the necessary impact tools that investors can use to realize both financial returns and inflict real positive change on the environment and society

ESG Commitments are more than just cheap talk

There are currently over 1700 institutional investment firms in the US who control over $8.4 trillion in ESG assets. Of these, 444 are mutual funds, with over $590 billion in ESG assets. For Mutual Funds in the US at least, the same study that we mentioned previously,The Economic Impact of ESG Ratings, also analyzes what happens with mutual fund average ESG holdings following MSCI ESG rating downgrades and upgrades. Their findings show that at least for the US mutual funds, ESG commitments are more than cheap talk. As Figure 10 below specifically demonstrates, the study shows that two years after a downgrade, ESG ownership is on average 13.1% lower and two years after an upgrade, it is 17.1% higher than one month before the rating change.

Figure 10: source: The Economic Impact of ESG Ratings

ESG and Returns do not Work Against Each Other

There are a variety of other studies that show that the returns of ESG funds overperform or at least do not underperform traditional funds. A recent study by Morgan Stanley, following the performance of sustainable and traditional U.S. funds for a time period 2004-2020, concluded that there are no trade-offs in the financial performance between the two on average.

Figure 11: ESG Equity Funds vs. Traditional U.S. Equity Funds. source: Morgan Stanley

With regard to Corporate Financial Performance, a study done by Deutsche Bank researchers has aggregated the results of over 2000 academic studies around ESG and corporate financial performance and their results are best summarized in our Figure 12 below. The study overall concluded that around 90% found non-negative relations, with a large majority of them showing positive findings across all major asset classes.

Figure 12: source: Deutsche Bank

ESG-Financial Performance Findings together with our Postulate 2, can put ConsciESG’s scores in a position to help our clients maximize the impact performance of their portfolios and realize significant financial returns.

Disclaimer: ConsciESG Research is working to establish statistical significance around the financial and social value of our solution. Sign up here for the white paper.