ConsciESG utilizes a rigorous model to evaluate companies based on their concrete advancements toward predefined ESG objectives. These scores are quantitatively derived and focus on 17 universal ESG themes, providing an unbiased measure of a company's contributions to environmental, social, and governance responsibilities. This methodology is particularly valuable for asset managers and financial institutions seeking sustainable investment opportunities. It can also serve as a powerful engine for companies who want to harness ESG to accelerate their shareholder value creation.

Our research examines the connection between companies' ESG scores, as evaluated by ConsciESG, and their key corporate financial performance, specifically Return on Equity (ROE) used in this study. By comparing the returns of top performers with those of bottom performers, we aimed to gain insights into how companies with stronger ESG impact may demonstrate better financial results.

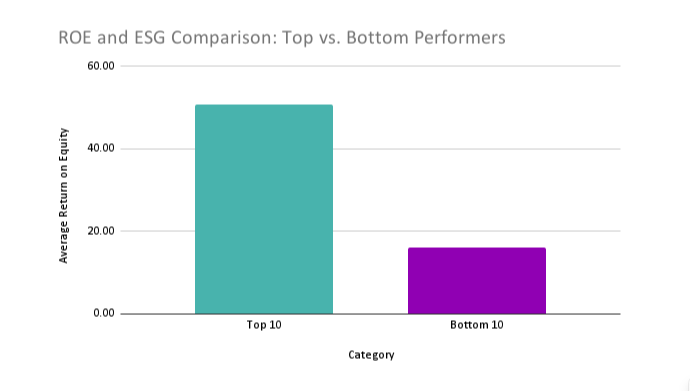

We initially selected 300 companies from various sectors. Using our unique methodology, we identified 10 top and 10 bottom performers based on their ConsciESG scores. To assess the impact of ESG performance on returns, we analyzed publicly disclosed ROE ratios for each company. We focused on the fiscal year 2020-2021 for evaluating both the ConsciESG scores and ROE ratios. These scores reflect the real progress of companies towards ESG targets, ensuring a comprehensive evaluation of their environmental, social, and governance practices. We then categorized companies into different portfolios based on their ConsciESG scores to validate our findings. The top-performing portfolio achieved a ConsciESG score of 15.93, indicating robust progress towards ESG goals. In contrast, the bottom-performing portfolio scored 11.39, reflecting relatively lower advancements in ESG practices. We found that the top performers' portfolios consistently showed higher average return on equity ratios than the bottom performers, as shown in Figure 1a.

Figure 1a: Analysis Based on ESG Scores and ROE Ratios for Fiscal Years 2020-2021

The results presented above form the basis for more investigative studies on the ability of the ConsciESG progress scores to predict financially superior sustainable companies and they bring important actionable insights for both corporates and their asset managers.