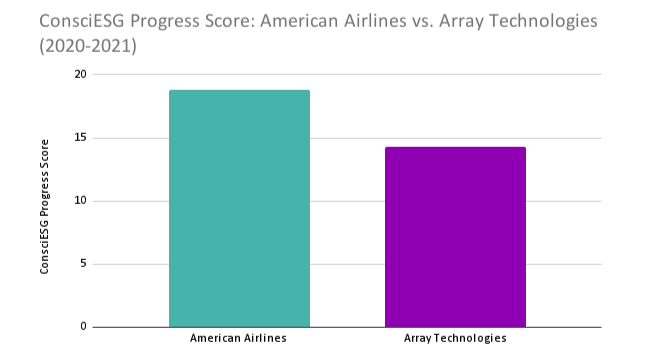

In our ongoing evaluation of corporate sustainability and financial performance, we previously conducted an ESG analysis using the ConsciESG platform to compare American Airlines, classified as a brown company, and Array Technologies, a green company. Contrary to expectations, our analysis revealed that American Airlines, despite its industry challenges, has made more significant ESG progress, achieving a score of 18.8, compared to Array Technologies' score of 14.27. To further explore the relationship between ESG progress and financial outcomes, we extended our analysis to examine the stock market performance of these two companies from 2021 to 2024.

Figure 1: Comparison of ConsciESG Progress Score

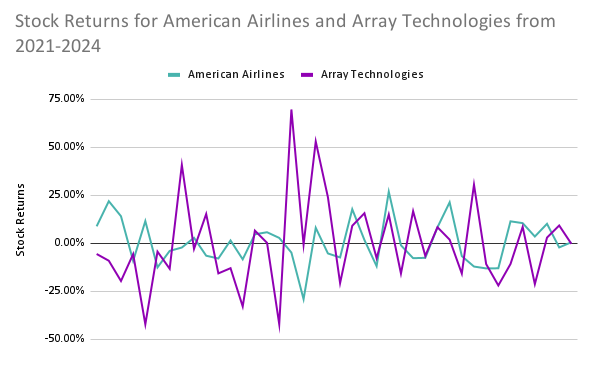

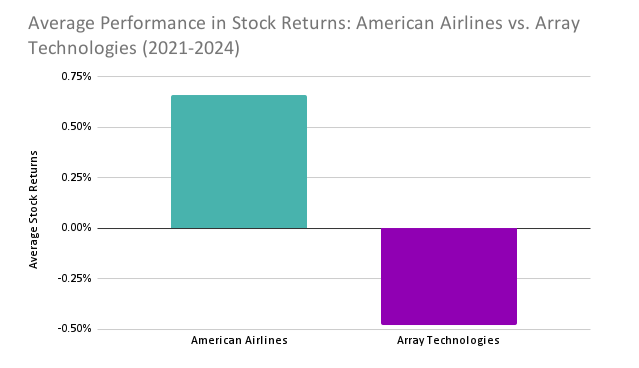

Figure 2a & 2b: Stock Returns over time and Average Stock Return for American Airlines and Array Technologies

The second graph illustrates the stock return volatility for American Airlines and Array Technologies over this period. American Airlines exhibited fluctuations typical of the airline industry, yet maintained a relatively stable performance, showing resilience despite economic pressures. In contrast, Array Technologies displayed more erratic stock returns, with significant peaks and troughs, indicative of the volatile nature of the renewable energy sector.

This observation is reinforced by the third graph, which presents the average stock returns for both companies over the same period. The data shows that American Airlines achieved a higher average return, outperforming Array Technologies despite the latter’s classification as a green company. The greater volatility in Array Technologies' stock performance, while expected given the sector's sensitivity to market conditions, raises concerns about the consistency of its returns. On the other hand, American Airlines, although experiencing some volatility, generally followed a more stable trajectory, underscoring its ability to navigate industry challenges effectively.

These findings suggest a strong correlation between ESG progress and financial performance. American Airlines, despite being classified as a brown company, not only demonstrated significant improvement in its ESG score but also achieved higher market returns compared to Array Technologies. This case highlights that companies making substantial strides in their ESG initiatives, even within traditionally challenging industries, can experience better financial outcomes. Utilizing the ConsciESG platform provides the ability to accurately assess ESG progress and link it with financial performance, reinforcing the value of focusing on sustainability as a driver for long-term success.