In the world of sustainable investing, green companies usually get most of the attention. However, recent studies show that ignoring "brown" companies could lead to missing out on important growth opportunities. Using the unique approach of the Consciesg platform, we found something unexpected: American Airlines, typically seen as a brown company, has improved significantly more than Array Technologies, a green company. This example highlights why brown companies should also be considered for investment portfolios.

American Airlines Group Inc., a major player in the aviation industry, is typically classified as a brown company due to its significant carbon footprint and environmental impact. Conversely, Array Technologies, Inc., operating in the renewable energy sector, is celebrated as a green company. Both companies were analyzed using public sustainability reports from 2020 and 2021, providing a basis for comparing their Environmental, Social, and Governance (ESG) progress.

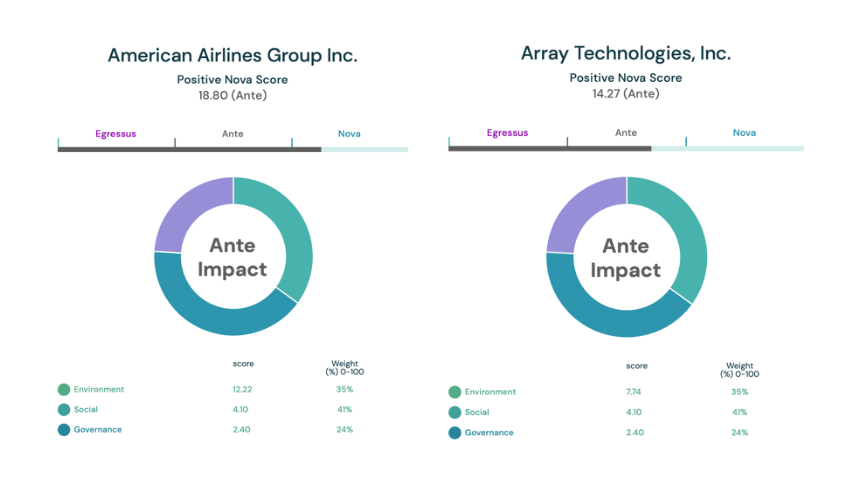

The ESG scores reveal a surprising trend: American Airlines, despite being in the carbon-intensive aviation industry, has made significant strides in its environmental impact, earning a commendable score of 12.22. This indicates substantial efforts in reducing its carbon footprint and improving fuel efficiency. Additionally, its higher Positive Nova Score of 18.80 reflects overall better performance in ESG dimensions compared to Array Technologies.

Array Technologies, a company in the renewable energy sector, scored lower overall with a Positive Nova Score of 14.27. While its environmental score is respectable at 7.74, it falls short of American Airlines’ progress. Both companies share identical scores in the social and governance categories, highlighting that their primary differentiator lies in their environmental impact.

These results underscore the importance of not dismissing brown companies like American Airlines. Their capacity for improvement and commitment to sustainability can lead to significant advancements, sometimes outpacing those of traditionally green companies. Consciesg’s model supports a transition towards financially sustainable portfolios by emphasizing the potential for progress in brown companies and providing detailed analytics that reveal their true impact potential. This forward-thinking approach allows asset managers to leverage Consciesg’s insights, integrating promising brown companies into portfolios to enhance both financial returns and environmental benefits. In an era where sustainable investing is gaining momentum, it is essential to adopt a more inclusive approach. As demonstrated by American Airlines and Array Technologies, progress and innovation often come from the most unexpected places.