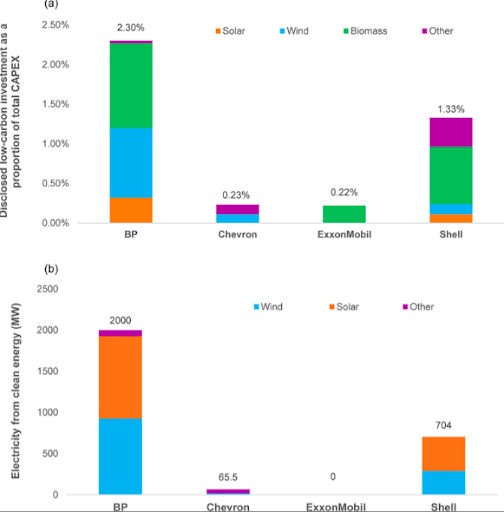

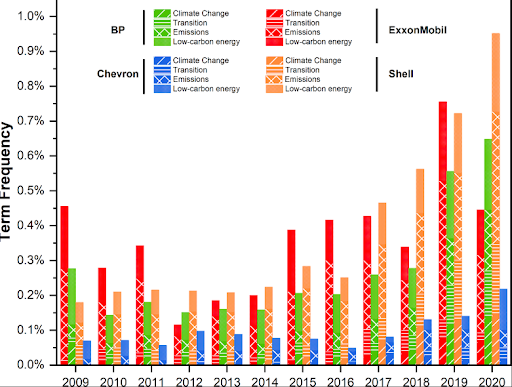

ESG is recently holding center stage and more so for the fossil fuels industry, for which 2020 was a year filled with greenwashing accusations. A recent peer reviewed study, has brought fresh evidence to the reality behind these accusations, comparing the discrepancy between the climate related keywords, targets and ambitions and the real actions of the four large fossil fuel companies: Exxon Mobil, Shell, BP & Chevron. Analyzing data for a period of 12 years, 2008-2020, the study found that all companies were far from realizing their targets, with Exxon and Chevron being the two top laggards out of the four. Figure 1 below demonstrates this phenomenon, where BP dominates both in terms of disclosure of low-carbon investments and clean energy electricity production, followed by Shell, Chevron and Exxon Mobil in that order. Regardless, most ESG risk scores that are informing investment allocations for this particular industry have been unable to reflect this ranking. For the purpose of demonstration, we picked Shell and Exxon and for the rest of this study, we will focus on showing the importance of our methodology at separating true impact from greenwashing and why this might matter from a financial perspective also.

Figure 1: Source: Li, Tencher & Asuka (PLOS One, 2022)

Postulate 1: Our scores are derived from current actions on material ESG themes and as such they can identify which companies are truly aligning their investments with their targets

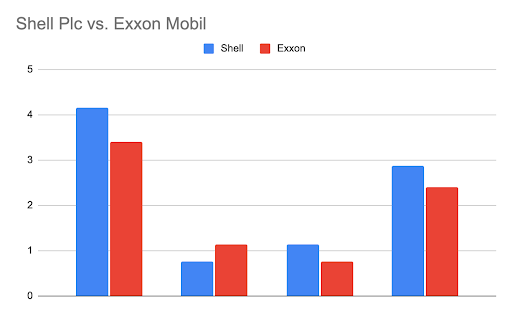

When we rated Shell & Exxon using our positive impact scoring methodology for 2021 we got the results as shown in Figure 2 below. Our scores are capable of replicating the results of the peer reviewed study shown in Figure 1 on the environmental front. In comparison to Exxon Mobil, Shell Plc is the more sustainable company according to our analysis, outperforming Exxon by slightly over 20% at the aggregate ESG level and by 22.59% at the Environmental level. Exxon outperforms Shell on the Social Level by 33.74%, while Shell again outperforms Exxon on the Governance level by over 50.93%.

Figure 2: Shell Plc vs. Exxon Mobil ConsciESG Impact Scores

(E, S, G & ESG impact scores from left to right) source: ConsciESG

Figure 3: Shell Plc vs. Exxon Mobil Relative Impact Performance. source: ConsciESG

For comparison, we have chosen two other leading providers of ESG ratings, Sustainalytics leader at ESG risk ratings and Refinitiv leader at the assessment of a company’s relative ESG performance, commitment and effectiveness. As seen, even after the greenwashing scandals and the paper’s results identifying Exxon as the company engaging in the highest amount of greenwashing, the risk scores of Sustainalytics still identify Exxon as the company that is doing a better job at managing their overall ESG risk.

Figure 4 below, demonstrates the risk scores and ranking that Sustainalytics has assigned to Exxon and Shell respectively. For the same year of 2021, Sustainalytics has assigned Exxon with a better ESG risk score, 36.5 and Shell with a higher risk score of 37.6. They both qualify as high risk, although Exxon ranks 62/275 and Shell ranks 70/275, in a system where 1st means lowest risk. A scoring system built on whether the company is doing a good job at properly communicating those targets is financially material but does not transparently reflect the real actions of companies to address and fix their ESG impact and they should not be interpreted as such by investors or other users of such metrics.

Figure 4: Sustainalytics ESG scores and ranking for Exxon Mobil and Shell Plc. Source: Sustainalytics

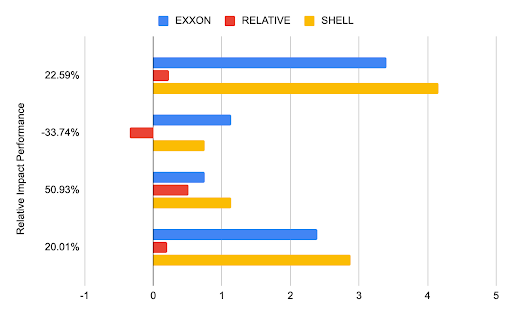

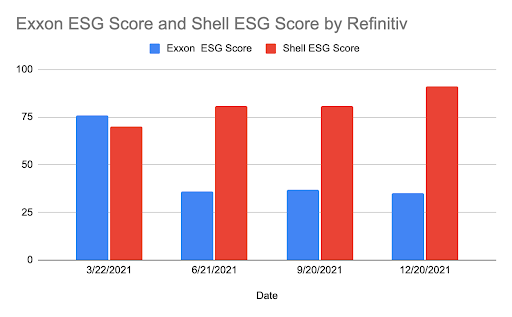

Refinitiv’s scores on the other hand, have managed to reflect the effect of the greenwashing scandals on the two companies' scores, resulting in a significant ranking switch between Shell & Exxon. Figure 5 below demonstrates that while Refinitiv like ConsciESG identifies Shell as a better performing company on ESG than Exxon, still its scores being a more complex aggregation of a company’s both environmental innovation targets and its CSR strategy, in our view can overestimate and in this case has overestimated Shell’s real actions.

Figure 5: ConsciESG vs. Refinitiv. Source: ConsciESG

To quote Refinitiv’s own methodology paper, we noticed that while CSR for us is an identification of company culture and not a material ESG theme, for Refinitiv it is a key category of its Governance pillar, associated with a 0.03 category weight. So are innovation targets and plans. To put this in light of the peer reviewed study, who has additionally identified Shell as one of the four companies also with the highest frequency of environmental keywords used, as shown in Figure 6 below. Without being able to re-derive Refinitiv’s scores, intuitively we can claim here that the large discrepancy between our scoring difference and that of Refinitiv’s for Shell and Exxon might pick up on the Refinitiv’s formula consideration of Shell’s CSR strategy, in additional to Shell’s ambitious targets for environmental investments and the high use of climate targets and keywords in addition to real actions. Again the main distinction here for our scores is that while our methodology, which is a pure impact metric derived from current actions only, estimates Shell to be overperforming Exxon on ESG by slightly over 20%, Refinitiv estimates Shell’s ESG performance to be 160% higher than Exxon’s by the end of 2021.

Figure 6: Climate Keyword Use Frequency Source: Li, Tencher & Asuka (PLOS One, 2022)