In recent years, Environmental, Social, and Governance (ESG) criteria have become a central focus for investors aiming to align their portfolios with sustainable and ethical practices. However, the narrative often leans heavily towards investing in "green" companies—those perceived as leaders in ESG performance. This approach, while well-intentioned, may overlook the potential of "brown" companies—those traditionally seen as less sustainable but are making significant strides in their ESG journey.

In a previous analysis, we evaluated a group of brown and green companies using ConsciESG's comprehensive ESG progress scoring system. The results revealed only a slight difference in their ESG scores, with green companies averaging 15.12 and brown companies close behind at 13.38. Given the close gap in ESG scores, it raises an important question: how does this marginal difference in ESG performance translate into stock market returns?

To answer this, we extended our analysis to include stock performance data from 2021 to 2024. The findings, visualized in the following figures, provide a compelling case for a more balanced and thoughtful approach to ESG investing.

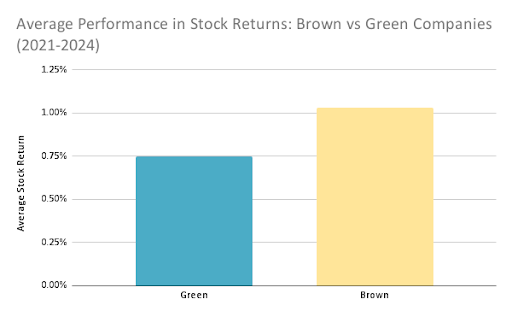

The bar chart shows that brown companies outperformed green companies in average stock returns over this period. Brown companies achieved an average return of approximately 1.00%, while green companies posted around 0.75%. This difference, although not vast, indicates that brown companies, despite their lower ESG scores, delivered better financial returns.

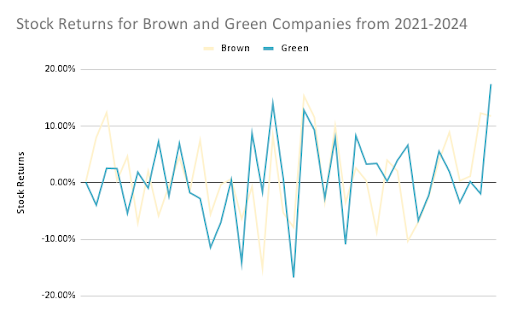

The line graph illustrates the stock returns of brown and green companies over the analyzed period. The returns fluctuate, reflecting the volatility inherent in the stock market. However, brown companies generally maintained higher returns, particularly towards the end of the period, where a significant spike can be observed. The green companies, on the other hand, exhibited more consistent returns but did not reach the same highs as the brown companies.

These results suggest that while green companies typically score better in ESG assessments, brown companies should not be discounted, especially regarding their financial performance. The slight difference in ESG progress scores between the two groups does not translate directly into stock market performance, where brown companies have shown an ability to deliver stronger returns.

This analysis, conducted using ConsciESG's advanced scoring methodology, underscores the importance of a nuanced approach to ESG investing. Asset managers and investors should be cautious not to overlook brown companies, as they may offer compelling investment opportunities despite their current ESG standing. ConsciESG's data-driven insights are invaluable in identifying such opportunities, enabling informed decision-making that balances financial returns with ESG progress.