The analysis of Environmental, Social, and Governance (ESG) factors is crucial in assessing companies' sustainability practices, but traditional ESG scores do no justice to transitioning brown companies. This case study demonstrates how ConsciESG scores can identify top-performing firms, even those traditionally considered "brown" due to higher pollution levels. Investing in such industries, like aviation, oil, and heavy manufacturing, often raises eyebrows among sustainability advocates. These sectors are typically seen as high-risk due to their environmental impact. However, this perspective overlooks the potential for significant ESG-driven transformation within these industries. By investing in firms committed to improving their ESG performance, investors can play a critical role in driving positive change while benefiting from substantial financial returns.

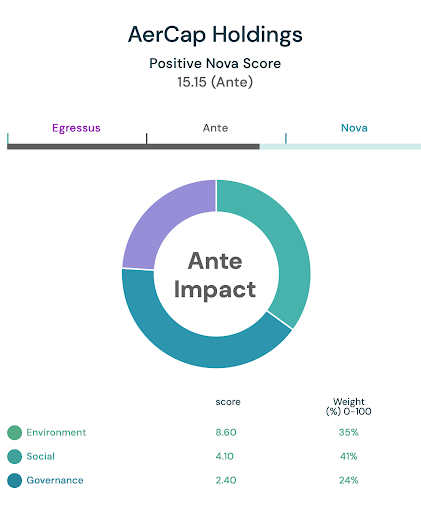

AerCap, a major player in the aviation sector, serves as an example of the benefits of investing in 'brown' firms committed to good ESG practices. Despite being classified as a brown company, AerCap has made significant progress in improving its environmental impact, social responsibility, and governance practices. After analyzing AerCap's public ESG data for 2020 and 2021, our methodology determined a score of 15.15, indicating strong performance in ESG metrics. For more detailed information, please refer to the images below.

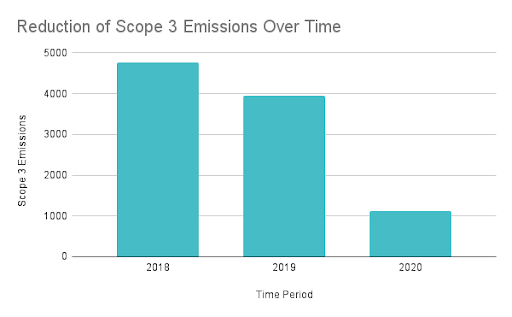

The graph shows a significant reduction in Scope 3 emissions from 2018 to 2020. Initially, emissions were at a baseline level in 2018. By 2019, the company achieved a 17% reduction, demonstrating an initial improvement. The reduction accelerated to 72% by 2020, reflecting a substantial enhancement in emissions management. This positive trend highlights the company’s effective strategy in reducing emissions over time. Based on this data, our methodology has assigned a progress score to AerCap, which is detailed in the image below.

The integration of ESG considerations into investment decisions is crucial. Yet, most metrics need to provide the necessary insights for such investments. This is where ConsciESG scores stand out, offering a reliable measure to guide investment choices, supporting the transition to sustainability, and realizing long-term, positive environmental and social outcomes. Emphasizing the importance of funding the transition to a more sustainable future, it becomes critical to consider brown companies in investment strategies. This approach aligns with sustainable development goals, creating a dual-benefit scenario where financial returns and positive societal impacts are achieved.