The transition to a low-carbon economy is not just an environmental imperative but also a significant economic opportunity. As various sectors aim to reduce their greenhouse gas (GHG) emissions, private equity (PE) firms are uniquely positioned to drive and benefit from these decarbonization achievements.

For private equity firms, the top decarbonizing sectors represent areas of growth, innovation, and potential competitive advantage. By understanding the trends and aligning their investment strategies accordingly, PE firms can not only enhance their returns but also contribute to the global fight against climate change. This case study analyzes the average annual growth rates of GHG emissions across different sectors for a 30 year time period and leverages predictive modeling to forecast sector-specific emissions levels in 2030.

Using a dataset on sectoral GHG emissions from 1990 to 2020 from Our World in Data, we first compute the average annual emissions growth rates for each sector, to help us identify which sectors are actively working towards their decarbonization. A linear regression model is then applied to predict the emissions levels for each of these sectors in 2030, which in turn can help the PE sector identify, at the aggregate, the sectors with the most viable sustainable investment opportunities.

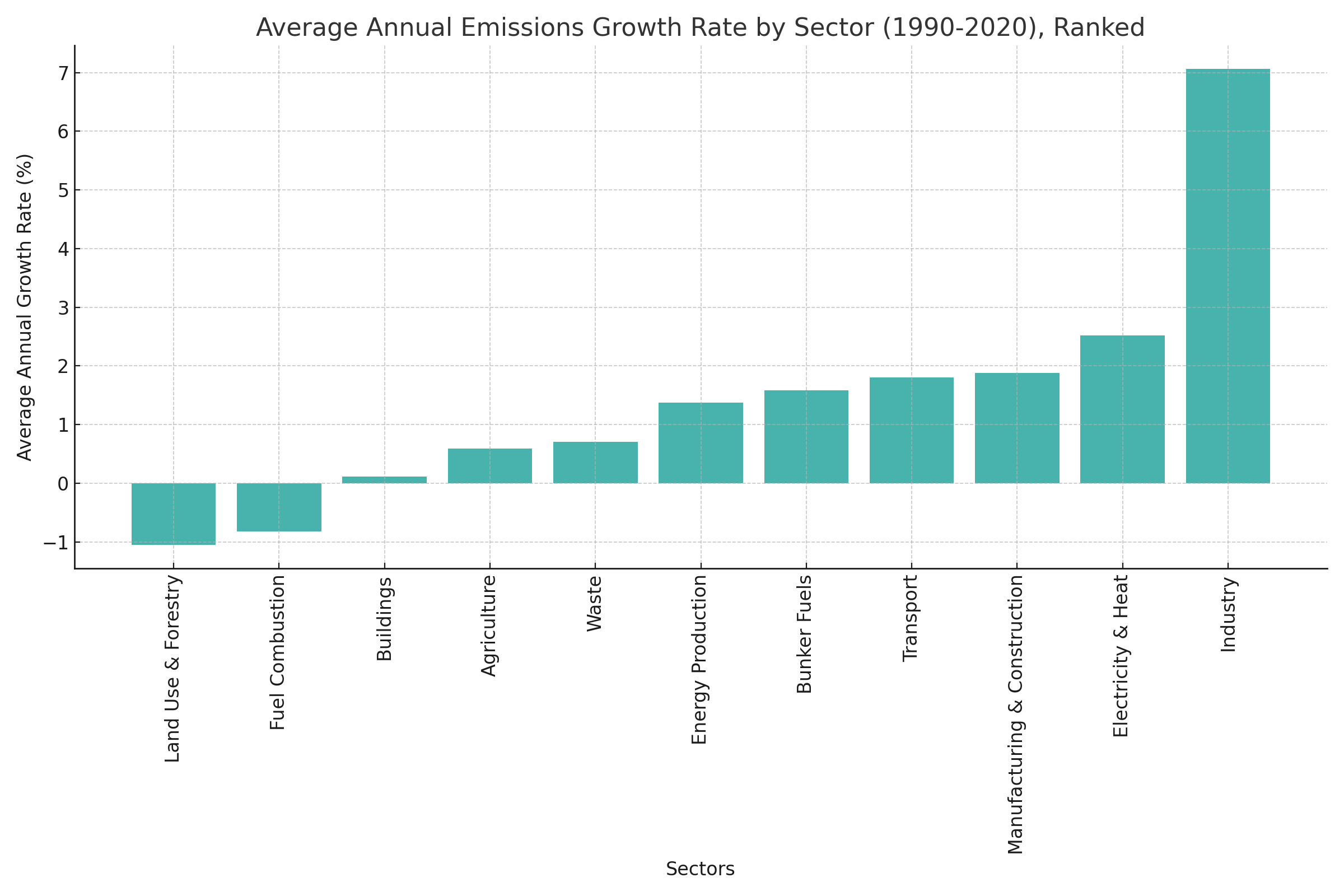

The sectors were first ranked as shown in Figure 1, based on their decarbonization rates and the top five sectors showing the most significant efforts to either reduce or control emissions were identified. The analysis revealed that the leading sectors in terms of GHG emission reduction are Land Use and Forestry, Fuel Combustion, Buildings, Agriculture, and Waste. These are sectors that have shown consistent results either to reduce or to control their emissions levels for the past 30 years.

Figure 1: Average Annual Growth Rates of GHG Emissions per Sector (1990-2020)

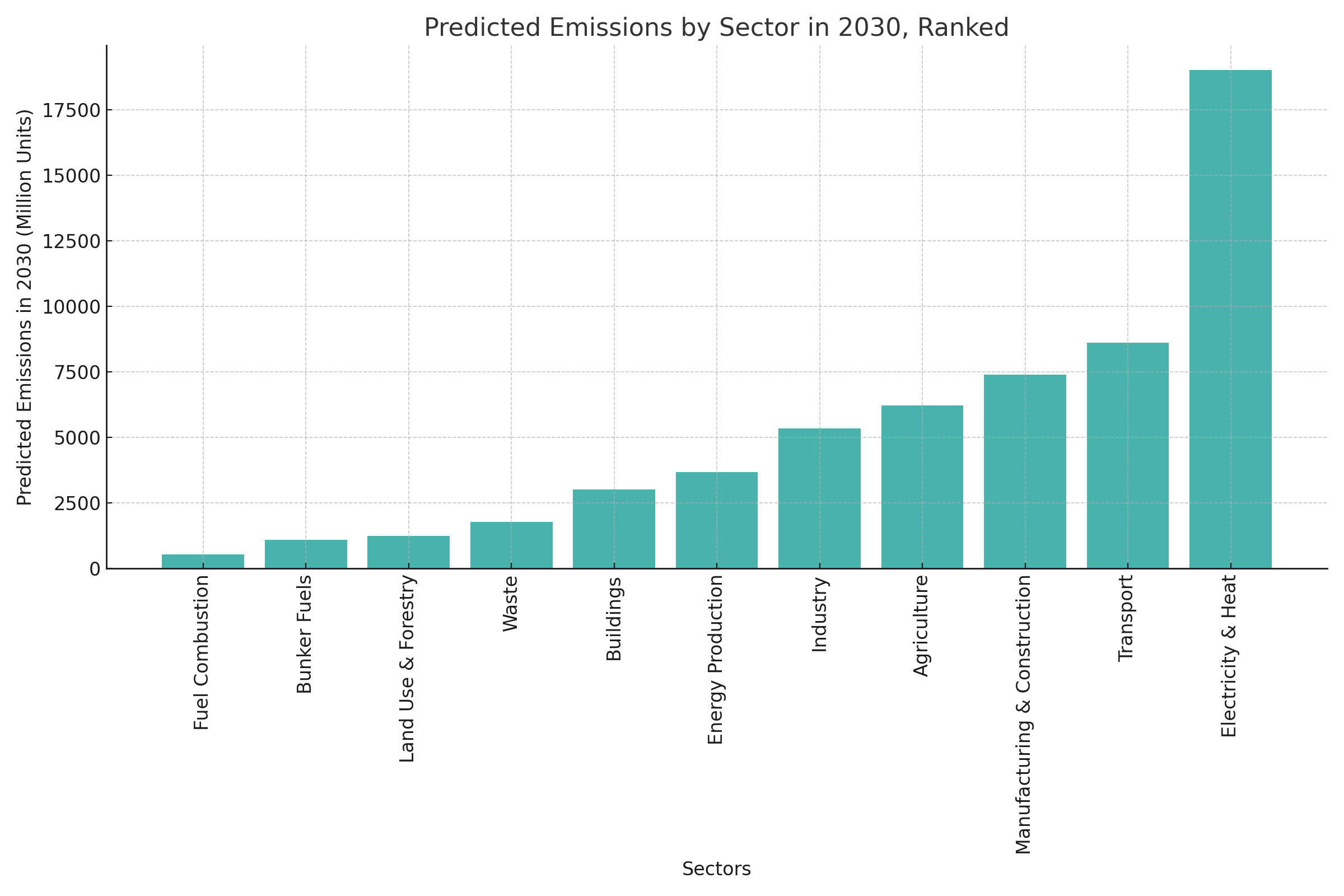

The predictive model additionally suggests a continuation of these trends, with the top decarbonizing sectors expected to further reduce and control their emissions by 2030. This presents a clear indication of where significant environmental and economic shifts are occurring. Accounting for both each sector’s existing emission levels and their current decarbonization rates, Figure 2 indicates that the least emitting sectors in 2030 will be Fuel Combustion, followed by Bunker Fuels, Land Use & Forestry, Waste, and lastly Buildings. The five most concerning sectors will in turn be Electricity & Heat, followed by Transport, Manufacturing & Construction, Agriculture and Industry.

Figure 2: Predicted GHG Emissions in 2030 for Each Sector

PE firms can internalize such results, by focusing on industries and companies within these top decarbonizing sectors. There's a growing market for sustainable and environmentally friendly technologies, products, and services. Investing in these areas can not only generate substantial returns but also position the firms as leaders in sustainable investments.

Additionally, as global attention on climate change intensifies, sectors lagging in decarbonization will be expected to face regulatory pressures, reputational damage, and a decline in market value. PE firms therefore need quality data and tools to assess their portfolios for such risks and consider divesting from industries likely to be negatively impacted by the transition to a low-carbon economy. Transition data and tools are key to that end and ConsciESG brings quality data and the first science-based model that can estimate consistent ESG progress scores of companies in a sector agnostic way, which in turn can help PE firms identify sustainable investment opportunities and also realize superior financial returns.PE firms can use the ConsciESG platform to additionally take a more active role in guiding their portfolio companies to reduce emissions and grow sustainably. This can enhance their portfolio companies' market positioning, operational efficiency, and compliance with increasingly stringent regulations.

The future is green, and savvy investors will be at the forefront of this transformation.