The recent “stakeholder movement” concerning ESG, is fueled the popular belief that stricter and more unified regulation will save ESG. On the other side of the spectrum are the less popular opinions that instead claim that companies have financial incentives (as for-profit businesses) in addition to non-financial incentives (business owners are stakeholders too) to genuinely improve their impact on material themes

In an attempt to bring these claims to the data, in this case study, we will compare the US’ approach known for its “laissez faire” approach to ESG against the EU, which offers a more regulations driven solution to ESG.

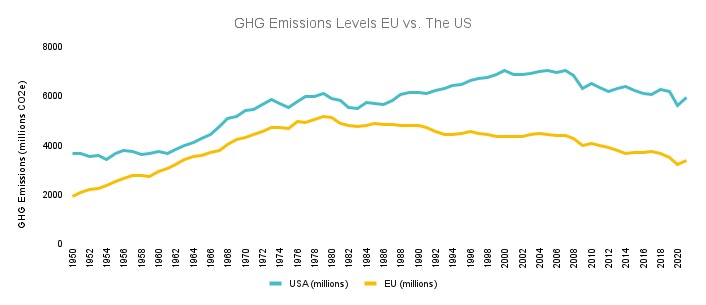

Figure 1 below, provides an overview of the overall GHG emissions levels since 1950 for both countries. The US emissions levels are below the EU, but the EU emissions display a significant reduction in absolute levels, in the last thirty years.

Figure 1: Historical GHG emissions series of all EU 27 countries combined vs. the US 52 states.

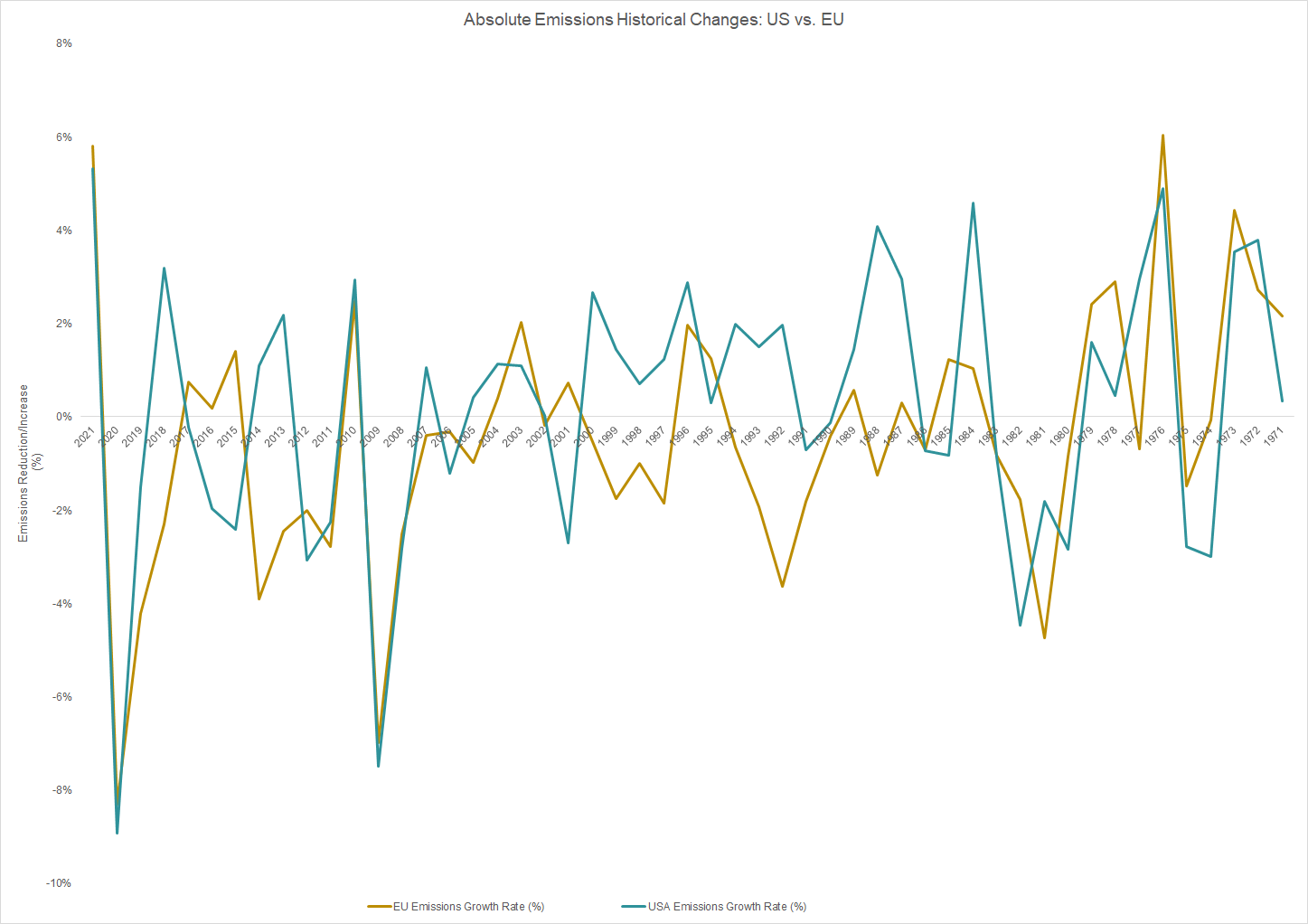

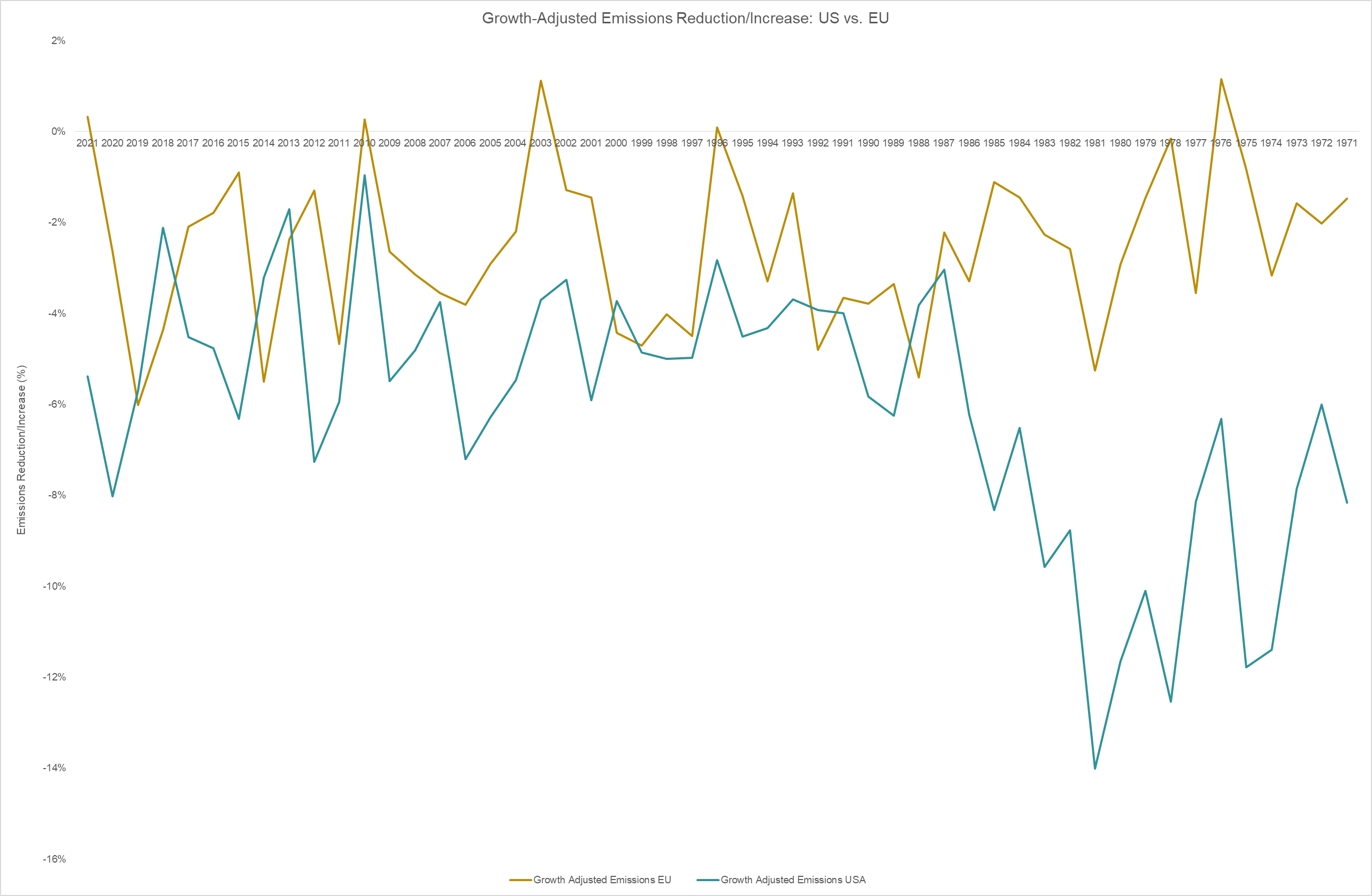

We assess the effectiveness of each approach by the actual reduction in GHG emissions observed in each macro economy. Therefore, the policy has been more effective if it has resulted in greater reduction in emissions over time. Figure 2 shows, that in absolute terms, the emissions reduction in the EU 27 countries combined has been higher. However, the results flip when we control for GDP growth. As shown in Figure 3, when we look at GHG emissions changes over time after controlling for the economic growth of either entity (emissions intensity), the US’s laissez faire approach seems to be the most effective.

Figure 2: The change in absolute GHG emissions over time: the US vs. the EU.

Figure 3: The change in growth-adjusted GHG emissions over time: the US vs. the EU.

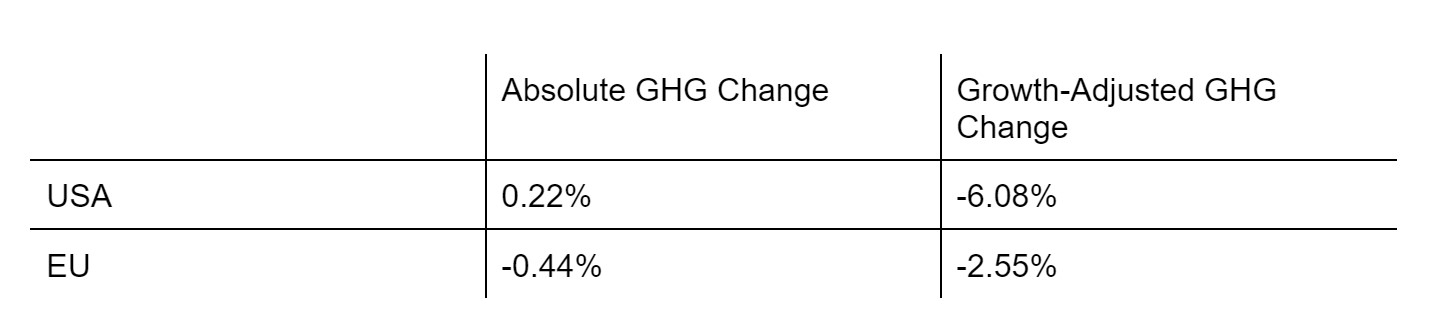

In Table 1, we compare the last 50-year averages for the absolute and the growth adjusted GHG emissions growth rates for the EU and the US. The average of absolute GHG emissions growth rate in the EU for the past 50 years has been -0.44%, while that of the US has been +0.22%. This is indicative that the EU regulatory approach to ESG has been most effective to reduce absolute emission levels over time. However, when we account for the different GDP growth rates in each entity, the results change into -2.55% emissions growth rate for the EU and -6.08% (almost double the reduction) for the US.

Table 1: Absolute and growth-adjusted GHG emissions reduction. (1971-2021 averages).

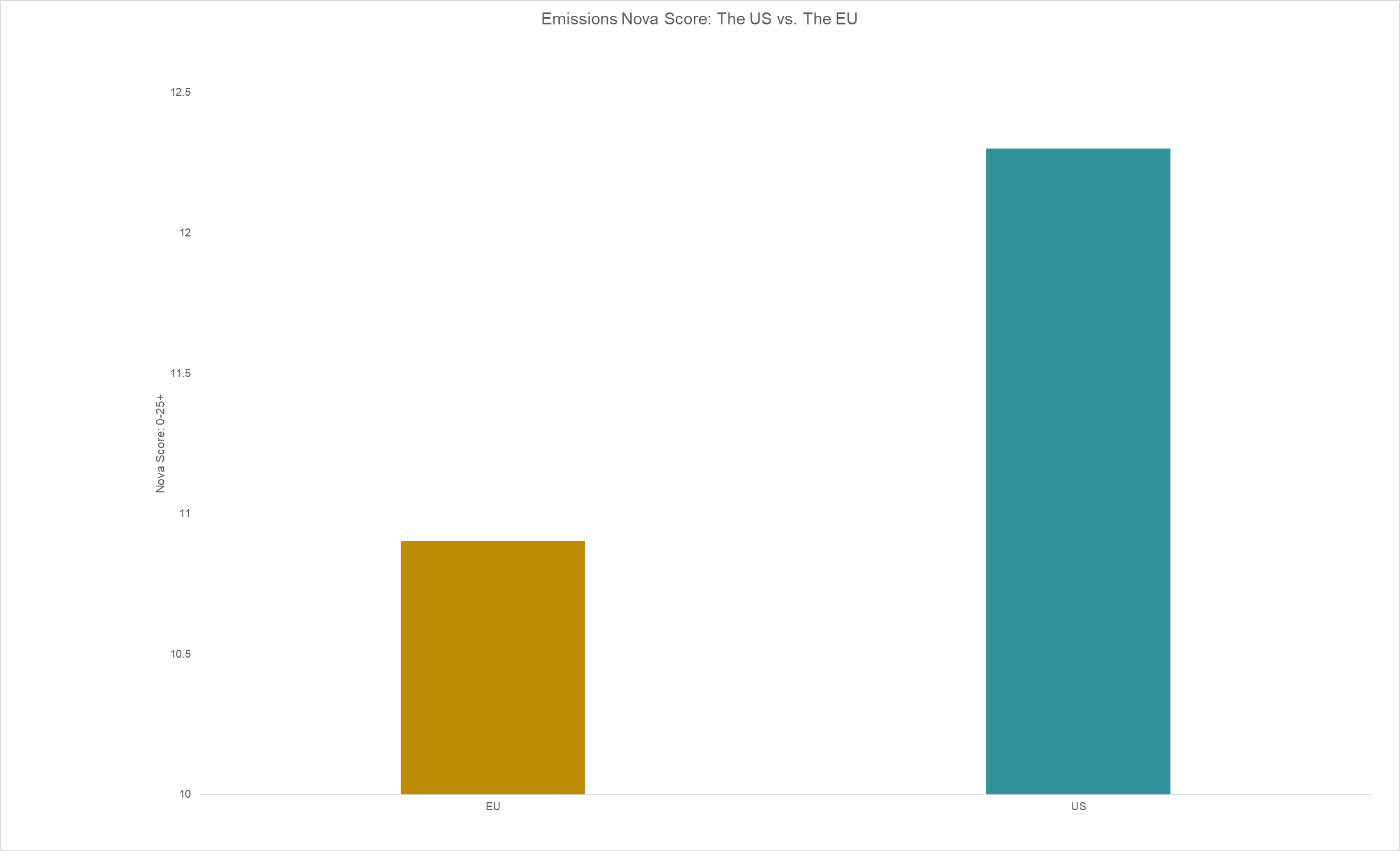

Finally, using our scoring approach, we rate the historical difference between the two. The US, with an average Nova Score of 12.30 overperforms the EU with an average Nova score of 10.90. Both however, seem to be on the lower end of the “Ante” category, which means that the progress to meeting targets for both economies is still in its infant stages and both economies must show more real actions instead of just efforts, in order to get closer to their targets. (Refer to Figure 4 below.)

Figure 4: 50-year average Nova Scores: The US vs. The EU.

The score goes from 0-25+ and a larger score is the equivalent of a larger reduction in emissions. The entities moving away from targets are in the 0-10 “Egressus” Category. The entities moving towards targets are in the 10-25 “Ante” Category and those that are close to meeting targets and may be soon overcoming targets has a starting Nova score of 25+.