ESG investing, having fallen from the grace of its promise to save the World, is currently undergoing major transformations. The hype of the potential of existing ESG funds to bring higher positive impact to the World was put to the test and its failure to deliver, brought the focus to the question on what should be done to deliver results. Yet, results depend on a variety of factors, some of which are beyond the control of the asset managers, such as wider availability of quality data and metrics, which can ensure that ESG assets are those truly aligned with global transition goals.

ESG Screening versus Integration

Taking the case of Blackrock, its US Impact Fund is built on the basis of “screening for controversial activity”. This fund relies on MSCI research to identify and exclude companies which are involved in business activities, either directly or indirectly, related to controversial sectors such as, tobacco, weapons, fuel & gas etc. Exclusionary ESG investing is preferred by major asset managers, as a practical way to easily tick boxes for Pension Funds and other stakeholders as clients. Regardless, this strategy has proven far from optimal for Blackrock and other similar US-based asset managers, where only recently as a result of their exclusionary ESG investing, over $4 billion in assets under management were divested from Blackrock.

The realized consensus around the use of exclusionary screening tools among asset managers, is that they are too aggregate, subject to proprietary methodologies, do not disclose the source data, which in turn makes it harder in the current ESG climate and under the existing regulatory pressures, to showcase the true impact performance of their investments. Direct interviews we have had with US based asset managers, including insurance companies and regulatory institutions, have confirmed that ideally what would work best for asset managers in the new ESG investing climate, would be integrating ESG factors on top of their existing investing models. Without deviating from their existing financial goals and strategies, reliable performance data and metrics can be integrated as an additional lens to ensure that an ESG fund delivers both value and profits. To do this, it is not necessary to exclude Shell or Exxon, but rather to show quantitatively why a company from a controversial sector might deserve it even more than a similar company from a greener sector, to be included.

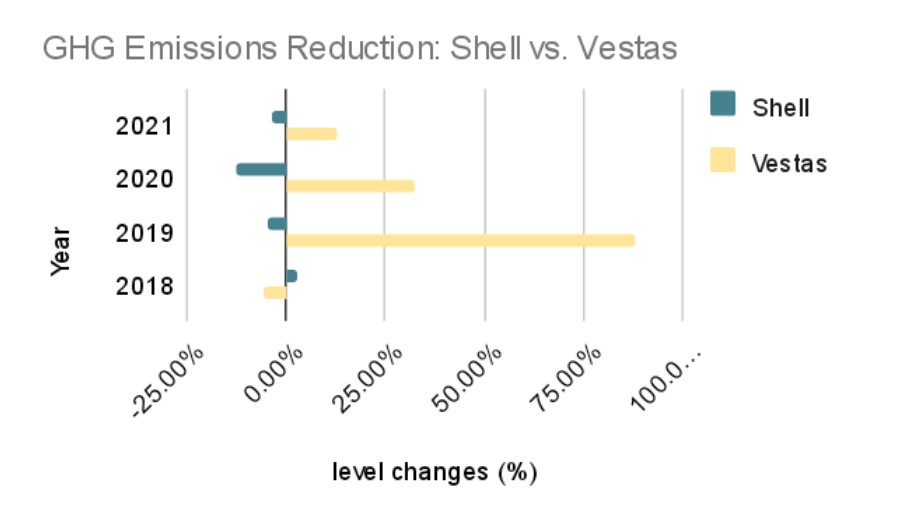

To make our point clearer, hypothetically, a net-zero transition fund in 2021, would be more target aligned if out of Shell and Vestas, it chose to invest in Shell. Figure 1 below, which gives a picture of the realized transition paths in the last five years for Shell and Vestas respectively, makes it clear that Shell, regardless of being in a polluting industry, is on the progress path to net-zero, having realized three consecutive periods of negative growth in their GHG emissions. To the contrary, Vestas, a green energy producer, seems to be ignoring its negative impact on the environment. Having realized positive growth in its overall emissions levels in every year from 2019 onwards, Vestas seems to be deviating from expected transition targets.

The result becomes even stronger, when we go deeper into the exact emission levels of Vestas, which in 2021 alone released over 10 million tonnes of overall GHG emissions (measured across scope 1, 2 and 3 jointly.) To put this number into perspective, the overall emissions produced by Albania in 2021 were 4.62 million tonnes. Vestas therefore, a company operating in a green sector, was accountable for more than double that amount of GHG emissions released into the atmosphere.

Figure 1: This figure shows the realized changes in overall emissions for Vestas (green energy producer) and Shell (fuel & gas company). The figure demonstrates how Shell is showing gradual progress at reducing emissions from year to year. The opposite seems true for the green energy company, Vestas, whose emissions seem on the rise from 2018-2021.

Overall, for ESG to truly deliver both value and profits, asset managers should have access to quality data that provide a deeper understanding of a company’s progress to targets, instead of relying just on the dry categorization of a company’s activities as either green or brown. As this case also points out, simply giving green sectors a pass does not help get the World closer to meeting its sustainability targets. Making better informed investment decisions will require asset managers to replace old ways which are not helping the society and risking their bottom-line, with innovative data and models, which reflect the World as it is and can help more accurately identify where it could be.

To learn more about our transition tools for asset managers, sign up for a demo here.